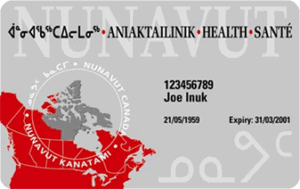

The Nunavut Health Care Plan is a product of the Canada Health Act. If you have the Nunavut Health Care Card, you are enrolled in the Nunavut Health Care Plan, and you can use this card to help cover the cost of medical services in Nunavut.

In some cases, you might even get coverage outside of the province.

You are not eligible for healthcare coverage in Nunavut through the Nunavut Health Care Plan if you are:

- Temporarily employed /studying in Nunavut for less than one year;

- A visitor/tourist;

- An inmate of a federal penitentiary;

- A person with a student or employment visa that doesn’t have a Nunavut address.

What is a Nunavut Health Card?

Registering for Nunavut Health Plan

You can register for the Nunavut Health Care Plan by filling out this application form and mailing it to the following address after printing it and filling it up:

The Department of Health

Health Insurance Programs

Government of Nunavut

Attention: Health Care Registrations Department

BOX 889 Rankin Inlet, Nunavut (NU) X0C 0G0

Eligibility Requirements

You are eligible for Nunavut Health Care if:

Applying for a Nunavut Health Card

Applying for a Nuvaut a health card is possible either in person, online, or through the mail. The methods to replace or renew your health card are similar to that of applying for one.

How to Apply in Person

There is no separate application procedure for the Health Care Card. Upon acceptance of the same application form mentioned in the earlier section, you get the Nunavut Health Card.

You can also pick up a form from any community health center, nursing station, or the Health Insurance Programs Office in Rankin Inlet.

You can mail the application to:

The Department of Health

Health Insurance Programs

Government of Nunavut

Attention: Health Care Registrations Department

BOX 889

Rankin Inlet, Nunavut (NU) X0C 0G0

How to Apply Online

Applying online for a Nunavut Health Card is fairly simple as you have the option to process your own documents according to Nunavut Department Of Health and email the form along with your documents to nhip@gov.nu.ca.

Forms and Documentation Required

Obtaining Nunavut Health Care is fairly straightforward and you don’t need to have extensive documentation.

The following documents are required:

- Proof of residency;

- Two copies of your ID (this can be your birth certificate, valid (unexpired) passport, or any immigration documents);

- Employment ID, driver’s license, or previous proof of health care insurance

If you are moving to Nunavut from within Canada, in addition to your birth certificate and health care card that is from the province you are registered in, you might also have to provide an employment contract or other proof of the fact that you intend to stay in Nunavut for an extended period.

If you do not have Canadian citizenship at the time of application, you must provide immigration documents.

If you are under 19 years old, your parents or legal guardian will have to sign the form.

How Long Does it Take for My Card to Arrive?

There isn’t a fixed period, anecdotal experiences mention that it takes a while to get your application approved. Sometimes it may take longer if the authorities require additional documents for verification.

It is also critical to note that the Nunavut Health Care Insurance Plan doesn’t become effective until the first day of the third month since registration.

While you are within the three-month waiting period, consider opting for private health insurance plans or check with your employer regarding the Nunavut Employees Benefits Program.

Renewing or Replacing Your Health Card

Nunavut Healthcare makes the process of renewing or replacing your health card very simple. You will only have to take action if you lose your card, or have to make changes to the information on it such as your name or address.

Renewing Your Health Card

The Nunavut Health Care Card automatically renews every two years. It does not expire on its own. Renewal may be affected if there is a change in details mentioned at the time of applying, such as a change in address, other personal information, or even loss of the card.

Replacing Your Health Card

On losing your Nunavut Health Care Card, you must contact the Health Insurance Programs Office in Rankin Inlet. You will need to fill out this application form (different from the original registration form) and mail it back to the office. This form is available at all health centers and nurse stations in Nunavut.

Changing the Information on Your Health Card

The form for replacing your health card after it has gotten lost or damaged is the same for the following:

- Change of address, either temporarily or permanently;

- Change of name;

- Change in ethnicity;

- Temporary absence from Nunavut (over 90 days);

- Change in any other personal information.

Nunavut Health Plan Coverage Summary

The Nunavut Health Care Plan is available to all Nunavut residents, i.e., any person residing in Nunavut for three months or more (continuous period) to stay for at least twelve months.

The Department of Health and Social Services decides whether someone is eligible for coverage. An additional set of Extended Health Benefits is also available, which can be opted for to pay for supplementary expenses such as prescriptions and medical supplies, medical travel, and medical equipment.

Drug Coverage

Alcohol and drug rehabilitation are not covered under the Nunavut Health Care Plan. Drugs prescribed by a doctor are not covered either unless these drugs are administered in the hospital by the physician.

Student Coverage

Individuals who have a student visa valid for one year or more with a Nunavut address are eligible for coverage under the Nunavut Health Care Plan.

Student coverage is not given if the student visa:

- Doesn’t have a Nunavut address

- Isn’t valid for at least 12 months

Medical Travel

Medical travel benefits get activated when a registered doctor, nurse, or any other qualified health care professional recognized under the Nunavut Health Care Plan advises you to leave your home to help with medical treatment and/or healthcare.

To be eligible, you must have been enrolled in (or if not enrolled, at least eligible for) the Nunavut Health Care Plan and fulfill the following conditions:

- Be a resident of Nunavut

- A healthcare professional deems it medically necessary to leave your home community;

- You must have exhausted all other third-party and employer insurance options;

- You must require travel benefits starting from the Nunavut region.

Under the Nunavut Health Care Plan, you get limited medical travel benefits. Please refer to the section on what’s covered and not covered under the Nunavut Health Care Plan.

Refer to the final section for medical travel benefits as under other extended health plans.

In case you are a visitor in Nunavut, you are responsible for your medical travel costs, and the Department of Health will only organize emergency medical travel to a health center or southern hospital. You will be invoiced for the full cost.

Medevacs (air ambulance services) will be arranged only if there is an immediate and urgent need to get the person to the closest facility for the relevant treatment.

In case medevac arrangements are needed, the following guidelines are critical:

- You will be given at least one hour to prepare for travel. Pack all necessary items, including photo ID, Nunavut Health Card, and other necessary documents;

- If the person requiring the medevac service is in such a set-up or condition that a family member cannot travel with them on the same flight, they will be sent on the next available flight.

Under the Nunavut Health Care Plan, the cost of the medevac services is covered (barring the CAD$125 deductible one-way and an additional CAD$125 for return airfare if opted for).

If you are not covered under the Nunavut Health Care Plan, you will be billed for the full cost of the medevac flight arranged by the Department of Health after the travel is complete. This can add up to CAD$40,000.

The Nunavut Health Care Plan does not cover accommodation and meals for people on the medevac. You can contact the Nunavut Health Insurance Program Office for more information:

Nunavut Health Insurance Office Information

The Department of Health

Box 889

Rankin Inlet, NU

X0C 0G0

Phone: (867) 645-8001

Fax: (867) 645-8092

Toll-Free: (800) 661-0833

More (downloadable and printable) resources to help prepare for medical travel:

- Medical Travel To-Do List

- Preparing for Medical Travel

- Medical Travel Contacts

- Client Code of Conduct

- Escorts Code of Conduct

- Medical Travel Factsheets

- Frequently Asked Questions Medical Travel

Coverage When Travelling in Canada and Outside of Canada

When those eligible under the Nunavut Health Care Plan travel outside Nunavut but within Canada (for business or pleasure), their benefits under the Health Care Plan will be extended when they require insured medical services.

Nunavut has entered into physician reciprocal agreements with all provinces barring Quebec, that allow for payment of insured services on behalf of Nunavut residents that have opted for the Health Care Plan.

This coverage extends outside of Canada as well. The coverage is capped at the rates equivalent to those paid if the services had been provided in Nunavut.

This capping of coverage means that there may be expenses that the Health Care Plan does not cover. The Nunavut Health Care Plan is limited in this respect and may not be able to cover emergency health services sufficiently.

For example, Nunavut’s air ambulance coverage across provinces can cost up to forty thousand dollars. Air ambulance charges are not covered if the air ambulance is opted for outside the province. Ground ambulance services are not covered either outside Nunavut within Canada or outside Canada.

As per an illustration on the government website, hypothetically, if your emergency outpatient visit while you are in the USA costs CAD$1700, Nunavut’s Health Care Plan will reimburse only $287. This illustrative example can, of course, be different from actual costs, but it displays a dire need for supplemental travel insurance.

To obtain a comprehensive protection net that covers every medical cost possible, you can consider opting for Nunavut Travel Insurance while travelling outside of the province or the country for extended periods.

Nunavut Health Plan Coverage Detailed

The Nunavut Health Care Plan includes:

- Treatment and diagnosis of illness and injury by physicians;

- Prenatal and postnatal care;

- Surgery, including pre-surgery and post-surgery assistance, if necessary;

- Nursing services provided by the hospital;

- ICU services at standard ICU rates;

- Eye treatments and operations done under ophthalmologist’s recommendations;

- Laboratory, x-ray, and diagnostic procedures;

- Physiotherapy, radiotherapy, occupational therapy, if provided by the insured facility;

- Medical travel within Nunavut;

- Operation room and case room facilities and anesthesia-related facilities.

Dental

Dental services that are not related to jaw injury or disease will not be covered.

The Nunavut Health Care Plan covers all mentioned costs associated with dental treatment and surgical procedures that flow from accidents, injuries, or illness.

Prescription Drugs

Under the Extended Health Benefits (more on this in the next section), you can benefit from coverage if you are:

- A non-beneficiary Nunavut resident with specified diseases;

- A senior above 65 years old;

- If you do not have any other health care insurance options.

Through the Extended Health Benefits, you can cover close to 20% of the costs of prescription drugs. The Nunavut Health Insurance Plan on its own does not cover prescription drug costs. It only covers the costs of drugs administered in the hospital by the physician.

We cover more details under the ‘Extended Health Coverage Plans’ section.

Student Benefits

As a student of an institution in Nunavut for not less than a year, you can access the same benefits as any other Nunavut residence after following the same procedure for application and registration. Your student visa should be valid for at least a year, and it should contain a Nunavut address.

Seniors Benefits

While there are no specific benefits for Seniors under the Nunavut Health Care Plan, you can opt for Extended Health Benefits to get coverage for:

- Ambulance charges within Nunavut;

- Cost of prescription drugs, including exception drugs;

- Medically required appliances, products, and supplies;

- Vision care services and products;

- Combined cost of a thousand dollars for dental care every calendar year.

You can register here.

We explore more details under the ‘Extended Health Coverage Plans’ section.

What Is And Isn’t Covered Under Nunavut Health Plan

As mentioned above in the brief checklist, the following services are included in the Nunavut Health Insurance Plan:

Doctor services such as…

- Diagnosis/treatment of injuries and illnesses;

- Surgery, including necessary anesthetic services and surgical assistance;

- Obstetrical care;

- Eye examinations, operations, and treatment.

Hospital services such as…

- Standard ICU services;

- Laboratory, x-ray, diagnostic procedures;

- Nursing services provided by the hospital;

- Drugs prescribed and administered by a physician in the hospital;

- Operation room, case room, and anesthetic facilities required for diagnosis and treatment;

- Radiotherapy treatment, occupational therapy, and physiotherapy.

The following services are not included in the Nunavut Health Care Plan:

There’s a lot of confusion about what is and what isn’t covered by the Nunavut Health Plan. Here’s a quick breakdown of common procedures and their coverage eligibility.

Private health insurance can help extend your coverage. Private insurance can cover the costs of prescription drugs, dental procedures, glasses, and more.

Keep reading to find out more about extending your health coverage.

Extended Health Coverage Plans

There are two extended medical insurance plans that you can take advantage of:

Extended Health Benefits (EHB):

Under the EHB program, you can cover services not included in the Nunavut Health Care Plan. This is also applicable to those not covered or fully covered by their third-party insurance providers, such as the Non-Insured Health Benefits (NIHB) program or workplace insurance plans.

You can opt for the EHB Plan if you are a Nunavut resident and a:

- Non-indigenous residents with one of the specified conditions. In such a case, under the EHB coverage, you may be able to get coverage for the cost of prescription drugs listed on the formulary under Specified Conditions, as well as the cost of medical supplies and appliances, their installation, and shipping. You can print the registration form from here.

- Non-indigenous resident Senior, i.e., above 65 years old;

- A resident who has exhausted third-party insurance or has no medical travel benefits. They can print the registration form from here. This coverage will include expenses for:

- Flight co-payment;

- Ground transportation between the healthcare facility/home of the resident and the airport;

- Ambulance charges for transfer between facilities;

- Private or commercial accommodation;

- Meals

- Long-term care plans at the time of recommendations.

You cannot opt for the EHB Plan if:

- You are not covered by a third-party plan by choice, or

- You are covered but don’t opt for specific services under the third-party plan by choice, or

- You are insured by a third-party plan that offers parallel benefits.

Non-Insured Health Benefits (NIHB)

This program is offered by the First Nations and Inuit Health Branch of Health Canada (FNIHB). They work in coordination with the Health Insurance Programs Office in Rankin Inlet via a Contribution Agreement.

You can benefit from coverage under this plan if you are:

- An Inul recognized by any Inuit Land Claim organizations;

- Less than one year of age, and your parent is eligible;

- Registered under the Indian Act.

You can use the Non-Insured Health Benefits only if you are not covered by other plans or have exhausted those plans. These benefits include the coverage of:

- Ground travel costs, including taxi fares to airports and ambulance costs to and from healthcare facilities;

- Air travel costs, such as the CAD$250 co-payment fees that you would have to pay under the Nunavut Health Care Plan;

You can fill out this form to claim medical travel benefits.

- Accommodation and meals (up to CAD$50 a day) for up to 90 days in approved boarding homes or hotels (only If the Department of Health recommends a hotel as the most suitable place for recovery) in Winnipeg, Yellowknife, Ottawa, Edmonton, Churchill or Iqaluit. If you use self-catering units for meals, under the NIHB, you will get up to CAD$50 a day for up to 44 days, followed by CAD$35 for the rest of the period till 90 days;

- Authorized assistant (only one, unless two are recommended by the Department of Health, in which case only the airfare will be covered for the second escort/assistant), including their meals up to CAD$50 a day (and same rule as above in case of self-catering units);

- If you are staying with friends or family, NIHB will pay CAD$50 a day for both the owner of the home and any authorized escort or assistant.;

- The entire cost of prescribed medical supplies and equipment bought through authorized vendors;

- Dental services, including cleanings, dental exams, x-rays, root canals, fluoride treatments, braces, and fillings;

- Vision services, including eye exams performed by a licensed eye doctor, and the cost of eyeglasses, both as per the NIHB Fee Grid. If the doctor says your condition medically requires lenses instead of glasses, the NIHB will pay for it;

- Prescription drugs.

You can mail all original receipts for taxi or bus travel, hotel stays, upfront expenditures related to vision care and dental care, and other supplies mentioned above, and/or the claim application forms to the following address to make a claim:

Nunavut Health Insurance Programs Office

Department of Health

Bag 3

Rankin Inlet, NU

X0C 0G0