Whether you're one of the thousands of Canadians who do not currently use the banking system or not, prepaid cards can be a great choice.

They allow you access to a lot of features of Visa and Mastercard debit and credit cards, but without many of the drawbacks. They give you control but also open lots of doors.

Let's take a look at how they work, who they work best for, and some of the best prepaid cards in Canada.

Disclaimer:

All, or some of the products featured on this page are from our affiliated partners who may compensate us for actions and or sales completed as a result of the user navigating the links or images within the content. How we present the information may be influenced by that, but it in no way impacts the quality and accuracy of the research we have conducted at the time we published the article. Users may choose to visit the actual company website for more information.

Prepaid Cards in Canada | In A Nutshell

More and more Canadians and customers across the world are taking advantage of prepaid cards as an alternative to debit and credit cards. Prepaid cards allow you to 'load' them with money. You then use them exactly as you would a credit or debit card.

That means that you can withdraw cash from an ATM. You can make purchases online from any vendor who accesses Visa or Mastercard. And you maintain complete control over how much you spend.

Many people find this a great way to control their spending and to budget effectively. It also eliminates the risk of getting into debt, either in the form of overdrafts or credit card bills.

Can Anyone Qualify for Them?

Prepaid cards are far more accessible than traditional cards. You don't need a bank account or a credit score to be able to access them.

If you'd like to have a credit card but are struggling to get accepted, this could be a great route. Certain types may even be able to help you qualify for a credit card in future.

Do They Improve My Credit Score?

That depends. There are two types of prepaid cards on the market - prepaid debit cards and prepaid secured credit cards.

With a prepaid debit card, you load up the card with funds and use it until it runs out or you top it up again. As there is no credit involved, using this type of card will not affect your credit score, either for better or worse.

Prepaid secure credit cards also require an upfront payment. This takes the form of a security deposit. The advantage of this is that the lender gives you credit and this allows you to build up your credit score.

By keeping up with your repayments, your credit score can gradually improve. But the opposite is also true. Getting behind with payments will negatively affect your credit score. The lender can use your security deposit to cover the resulting charges.

Where Can You Buy A Prepaid VISA or Mastercard in Canada?

Prepaid cards are available from a range of financial institutions in Canada. These include Vanilla, Canada Post, KOHO, MOGO, Stack and Scotiabank. Some can be bought in stores but most are available by applying online.

They all come with different pros and cons, charges, limitations and perks.

Vanilla Prepaid Mastercard

The Vanilla prepaid card is available at Walmart stores throughout Canada. It's a little different from some other prepaid cards on the market. It is purchased in denominations of $25, $60, $50, $100 or $200. They have an activation fee, ranging from $3.95 to $6.95.

They are not reloadable, so they're best used as a gift card. You do not need a PIN to use them, and they never expire. They are accepted anywhere that the Mastercard symbol is seen.

Canada Post Prepaid VISA

Canada Post is not typically where you might think of going for banking services. However, this venerable institution now offers the Canada Post Prepaid Visa - and it could be a great option if you want to spend online or go travelling.

You don't need a credit score to get one, and your transactions on it do not affect your credit rating. Also, because it's not linked to a bank, it gives you more anonymity when making online purchases. If a fraudster got hold of it, they could only spend the amount loaded on it.

It's easy to manage through the Zenwallet app. This allows you to track your spending in real-time. Apart from the initial fee of $15, there are no further fees to pay. There is no interest, as you are not borrowing money. You can even give it to a loved one as a gift. And of course, you can load it up in any branch of Canada Post.

All your need is your government-issued photo ID and cash to load onto the card and you can start spending straight away.

KOHO Prepaid VISA

Never heard of KOHO? Don't worry, they're legit.

KOHO is a fintech company - that is, a company that operates purely in the electronic financial services field. They don't have brick-and-mortar branches like banks but offer many of the same services. They have partnered with Visa and People's Trust to offer their prepaid Visa card.

You can open an account with them through their website. For their basic account, there are no fees and they offer 0.5% cashback on all purchases. Again, you have to put money into the account to spend it.

They also offer a KOHO Premium Visa, which does have a fee of $84 per year, or $9 per month. This account ups the cashback to 2% for certain categories of spending. It has no foreign exchange fees and allows you 1 free international ATM withdrawal per month.

You can use it as you would any Visa card and can withdraw cash from ATMs without any charges.

MOGO Prepaid VISA

Marketed as the Mogo Visa Platinum Prepaid Card, this card is brought to you by another fintech company - Mogo. They started in 2015 and have already won awards in the fintech sector.

You can apply for a card through their website. It has no monthly fee, 2% bitcoin cashback on all categories and does not require a hard credit check to obtain a card.

They also offer some unique additional features. This includes identity fraud protection and credit score monitoring. Both of these are included for free. Another cool feature is that for every dollar you spent on your MOGO Prepaid Visa, they pledge to offset a pound of CO2 through our Amazon Rainforest project.

However, there are some fees to consider. For using an ATM in Canada they charge $1.50. If you use an international ATM, that goes up to $3.00. There's also a 2.5% foreign currency transaction fee.

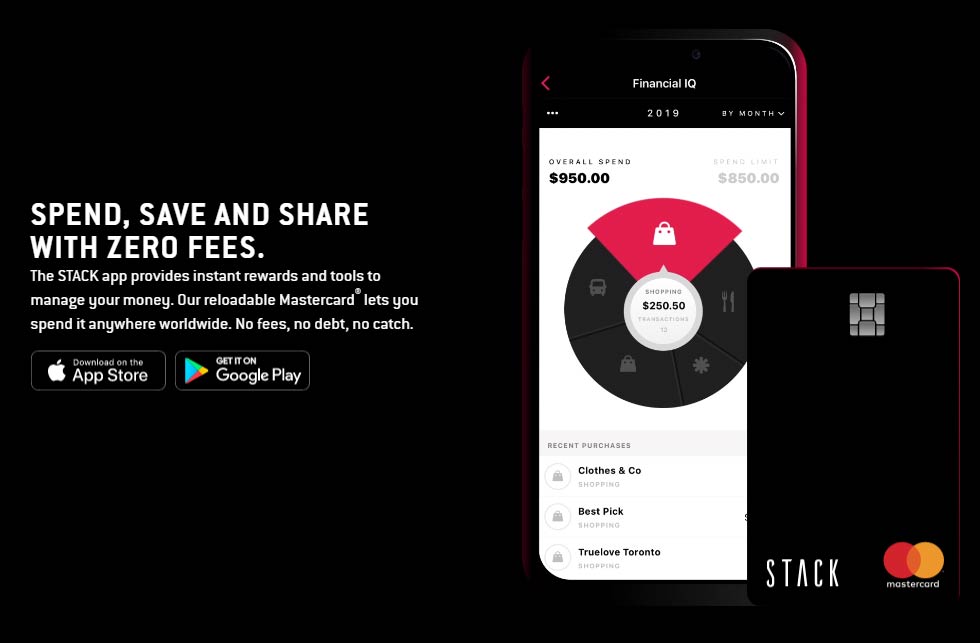

Stack Prepaid Mastercard

Stack is also a fintech company, based in Toronto. They may not be a familiar name, but they're totally legit. Their prepaid Mastercard also has some great features. There's a $0 annual fee, no foreign exchange fees and no ATM fees.

Additional cashback can be earned by using STACK Travel. This allows you to get 20% cashback on select hotels when you book using your prepaid Mastercard.

You load the card and use it anywhere that accepts Mastercard. They also offer cashback and special offers from selected retailers. There's no credit check needed to get hold of this card, but that also means that it won't help to improve your credit score.

Reloading can be done in person at any branch of Canada Post and over 10,000 other stores nationwide. There is no fee to reload.

Scotiabank SCENE Prepaid Reloadable VISA

Scotiabank is a much more familiar name to most of us. How does the Scotiabank SCENE Prepaid Reloadable VISA stack up?

Like other cards, you load it and use it up to the amount you put on the card. There is an annual fee of $10 and a one-off purchase fee of $10, which will be taken from your first value load.

Scotiabank has set a maximum balance of $2400. They allow you to reload your card through your Scotiabank account through Scotia OnLine or mobile banking. You can use the card wherever you see the Visa sign when shopping in-store or online.

The Verdict

There are a lot of choices available in prepaid cards in Canada, with every card coming with its pros and cons. What is the best prepaid card in Canada? Well, that's going to depend on your circumstances and what you need from the card.

With no credit checks and no chance of going overdrawn, they're a great way to keep control of your spending. You can shop with confidence, and have the flexibility that comes from having a Visa or Mastercard.

At Insurdinary, we want to help you scour the market for the best deals for your financial health. That includes insurance, banking, and managing your credit score. Check out our credit card comparison tool to see what options are available to you.