Do you struggle to take care of your children, even with the Canada Child Benefit? Fortunately, the Canada Child Benefit increase aims to help you pay for relevant expenses.

Whether you have an only child or a bigger family, you can obtain the money you need to cover basic needs such as food, clothing, and more.

Keep reading to learn more about the benefit increase and how to use it.

What Is the CCB?

The Canada Child Benefit (CCB) is a monthly payment that families can use to help raise children. If you qualify, you can obtain tax-free money to pay for childcare expenses.

CCB requirements include:

- Living with a child under 18

- Being the primary caregiver

- Canada resident

You or your common-law partner or spouse must be a citizen, permanent resident, a temporary resident, a protected person, or an Indigenous person. If you meet all of the requirements, you may obtain the CCB.

When you and your child's other parent separate in Canada, you may still qualify for the CCB. If the child lives with you most of the time, the government states you have full custody. You will be the only parent eligible for the Canada Child Benefit.

If your child lives with you both, you will have shared custody. You and the other parent must inform the Canada Revenue Agency (CRA) of the situation.

The CRA will calculate how much money you and the other parent may receive. Then, you will get half of that amount, regardless of if your child spends slightly more or less time with you.

What Is CCB Notice?

The CCB notice is a letter that you receive if you have a child under 18 and you've applied for the benefit. You may also receive the Canada Child Benefit notice if you already received the universal child care benefit or the Canada child tax benefit.

Your notice will include how much money you will receive, the payment period, date issued, and tax centre. It includes the amount that the CRA deposited into your bank account and when.

The notice may also show if you need to repay part or all of your benefits. You will need to file your taxes every year to obtain the assistance for as long as you're eligible.

Is CCB Going Up in 2021?

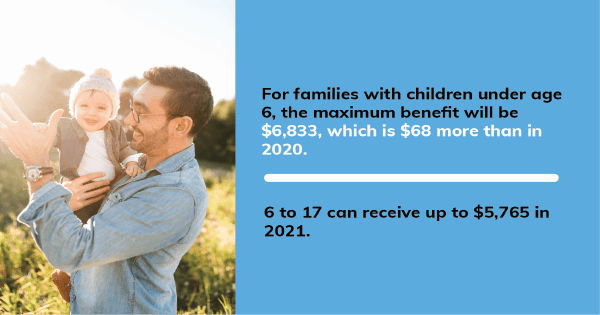

The CCB is going up in 2021, and the increase depends on your family situation. For families with children under age 6, the maximum benefit will be $6,833, which is $68 more than in 2020.

Parents of children ages 6 to 17 can receive up to $5,765 in 2021. In both cases, the maximum benefit is per child in that age range.

Even if you don't qualify for the maximum benefit, you may receive an increase compared to your benefit in 2020.

When Will I Receive My First CCB Increase?

You will receive your first Canada Child Benefit increase after the CRA determines you're eligible. In general, the CRA will pay the benefit on the 20th of each month.

Exceptions to the rule apply when the 20th falls on a weekend or holiday. When that happens, you will receive your benefit on the business day before the 20th, specifically:

- February 19

- March 19

- June 18

- November 19

- December 13

The CRA says to wait five working days from the payment date before contacting them if you don't receive your payment. Then, you can figure out the issue regarding your benefit.

Once you receive your first Canada Child Benefit increase, you will continue to receive payments each month. You can receive the payments via direct deposit to obtain the money more easily.

How Much Will the Canada Child Benefit Increase?

The child tax benefit increase depends on a few factors, such as your child's age, the number of children you have, and your income. If you qualify for the maximum benefit, your CCB will increase up to $68 for a child 6 years or younger.

For families with a child between 6 and 17, the benefit will increase by $57 compared to 2020. The CCB increase in 2021 helps to combat inflation as well as provide more assistance to Canadian families.

Consider how your family situation can affect the Canada CCB increase you can expect.

Number of Children

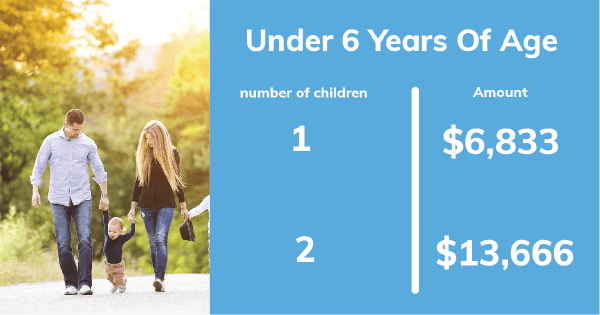

You can obtain up to the maximum benefit for each child you have. Consider a family with one child under 6 years old. Families that qualify for the maximum benefit will receive $6,833 throughout the year from July 2021 to June 2022.

If you have the same family income but have 2 children under 6 years old, you would receive $13,666 for the same period. The CRA is also offering an additional $1,200 to parents of children under 6 in 2021.

This increase is part of Canada's assistance to families during the COVID-19 pandemic. While it won't continue in the future, it can be helpful now.

When it comes to children ages 6 to 17, you can receive up to $5,765 from July 2021 to June 2022. You can obtain this amount per child in that age range, so a family with 2 older kids, may secure up to $11,530.

Unfortunately, if all of your children are between 6 and 17, you won't receive the extra benefit because of the pandemic. But you can still use the extra benefit that you do receive.

Having children under and over age six won't disqualify you from receiving the CCB. However, you will receive more money for the younger child.

Income Threshold

The income threshold for the maximum Canada Child Benefit is $32,028 in 2020. No matter how many children you have, you may receive the most money based on your children's ages.

Families earning between $32,028 and $69,395 in 2020 will receive partial benefits. The benefit will phase out as follows:

- First child: 7%

- Second child: 13.5%

- Third child: 19.5%

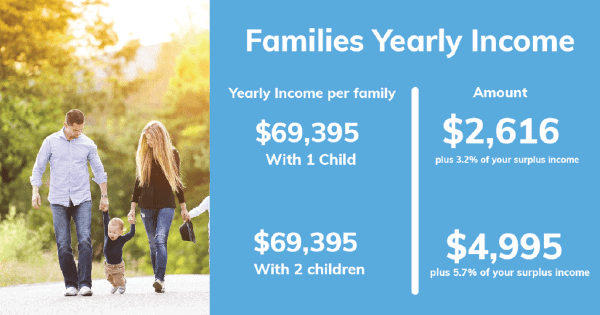

If you earned more than $69,395 in 2020, you may still qualify for some assistance. For your first child, the CRA will phase out your benefit by $2,616 plus 3.2% of your surplus income.

Families with two children will see a similar phase-out of $4,995 plus 5.7% of your surplus income. A phase-out of $7,029 plus 8% applies if you have a third child.

What Is Considered to Be Low Income and Middle Income?

Low income and middle income in Canada depend on the number of people in your family. For example, a single parent with one child is low income if the parent makes less than $32,899 per year.

However, a family of four is low income if the parents make $49,106 in the same period. If you have a spouse and three children, you would be low income if you make $55,695 per year or less.

Middle-income Canadians make anywhere from $35,000 to $100,000 per year. The exact amount can vary based on how many children you have and if you live in a province like Alberta vs. Ontario.

Do You Need the Increase?

Some families may not need the Canada Child Benefit increase. If you receive a raise at work, you may earn enough to cover your childcare costs.

The same is true if your child starts school and you don't need daycare services. And if you have a teenager reach 18 years old, they may be sufficient enough to pay for their expenses.

Consider if you used all of the money from your benefit in 2020. If not, you may not need the increase in 2021, but you can still receive it. Then, you can use the extra money for other costs or investments.

Interested in Investing?

If you don't need the entire CCB that you receive, you can do a few things with the money. For one, you can deposit into a tax-free savings account (TFSA) or a Registered Retirement Savings Plan (RRSP), both of which are excellent accounts.

As your kids grow up, consider using the benefit to teach your children about saving money. Deposit the money in a savings account for your children so that they can learn how to manage money.

The account can be a general savings account, or you can use it for future expenses, such as college or university. That way, you won't have to pay as much later.

If you still have money left, you can donate it to charities that you care about. Consider your interests or those of your children to find an organization that needs donations.

You may also receive a cash advance on a child tax credit in Canada. Then, you won't have to wait until you receive the money before you can start saving or investing it.

Other Ways to Use the Benefit

If you share custody of your child, one great way to use the benefit is on travel costs. Then, you can save money sending your child back and forth between you and their other parent.

The benefit can also help pay for new toys or other activities to entertain your child during their travels. Even children who don't go back and forth between homes can use new toys.

Will You Receive the Canada Child Benefit Increase?

The Canada Child Benefit increase is excellent for families in need. You don't need to be low or middle-income to receive some assistance, and you can use the money to help care for your child.

Before you decide how to use the benefit, consider how much you can get with the increase. Then, you can make a plan to prepare your children for a successful financial future.

Do you want to set up a bank account to store your CCB? Use Insurdinary to compare the best bank accounts in Canada.