In 2019, there were 372,038 Canadian babies born to families across the nation. As of 2021, there were 359,533 little ones brought into this world.

If you're thinking about having a baby yourself, you have to consider, "how much does it cost to raise a child?" and how that cost will impact your family's financial situation. The cost of raising a child has changed over the years. About 20% of Canadian children come from impoverished families, making this much more difficult. A report in February of 2021 found that approximately 3.7 million Canadians are living below the poverty line, which is 10.1% of the population.

What is the cost of raising a child in Canada specifically? Is there a way to know how to save money while raising a child?

Learn more about the cost to raise a child in this country and whether or not it is something you can truly afford.

The Cost of Food for Raising a Child

The cost of food is one of the biggest costs that you may not spend that much time considering, but it's important that you do. Families that want to focus on healthy eating may have to pay a little bit more.

While food costs are increasing in Canada, the income levels for many families are remaining the same. In a recent 2022 publication by Canada's Food Price Report, a Canadian family of four is expected to pay an extra whopping $966 for food this year. If you're adding another mouth to feed to your family, especially if the child may have allergies or special dietary needs, you have to consider the cost of food for years to come.

Many women breastfeed obviously, but for those who cannot, formula is the only option for providing your little one with the liquid nutrients needed to grow and sustain. While formula has come a long way, it's also very pricey. The average yearly cost would be anywhere from $900-$3000/year.

Clothing Costs for Raising a Child

Many parents love to shower their new baby or child with cute clothing, but the cost of this adds up really quickly. Many parents spend as much as $76 per month in the baby's first year, but of course, this is affected by income levels.

As your child gets older, they may require special clothing for sports or other activities that they are involved in.

Babies grow relatively fast, so you will have to replace clothing often for the child as they grow well into their teen years.

Luckily, there are better options than buying new clothing every time your child outgrows something. One of those options, Once Upon a Child, makes it easy to sell clothing your child doesn't use anymore and buy clothing that another child doesn't use anymore - a win-win situation.

Diapers

With diapers, the numbers you need tend to decrease the older your child gets. But that doesn't change the massive amounts you'll need, especially in the first two years.

On average, parents will change 60 diapers in the first ten days of a child's life, which means the largest box you can find, usually containing 144 diapers, won't last an entire month. The cost of a box this size usually runs around $40. This means that you will be spending upwards of $500 per year on diapers alone.

Daycare Costs

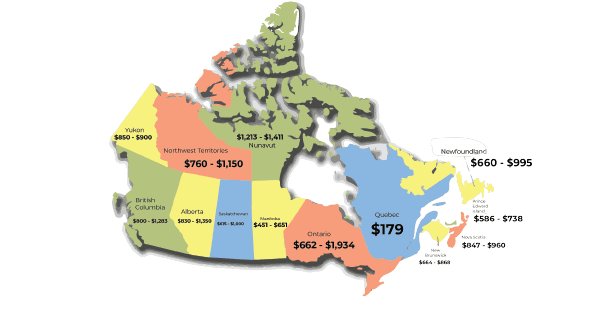

Prices will vary based on whether you go for a full-day daycare centre or if you choose a family or home-based childcare centre. For the purposes of average costs here, we will focus on the cost of full-day daycare centres in each province.

The price also varies based on the age of the child. For instance, infant and toddler costs are typically higher than preschool costs because these younger children require more attention and care. For this reason, we will provide a range of prices in Canadian dollars that cover these ages.

The average range of full-day daycare prices per province are as follows:

- Ontario: $662 - $1,934

- Alberta: $830 - $1,350

- Manitoba: $451 - $651

- British Columbia: $800 - $1,283

- Newfoundland/Labrador: $660 - $995

- Yukon: $850 - $900

- Nunavut: $1,213 - $1,411

- Prince Edward Island: $586 - $738

- Saskatchewan: $615 - $1,000

- New Brunswick: $664 - $868

- Nova Scotia: $847 - $960

- Quebec: $179

- Northwest Territories: $760 - $1,150

Parents in Quebec are at the highest rate of daycare use with 58% of parents using these services.

The cost of daycare is different in major cities because these businesses usually have to pay more to operate in those cities, but they also know that income levels are typically higher for parents in these urban areas. Each province has their own Child Daycare Subsidy programs which are available to parents to assist in off setting the cost of daycare. This is solely based on income however, and government tax assessments are required to determine eligibility.

Transportation Costs of Raising a Child in Canada

There will be costs associated with transporting your child, such as to school, to activities, or to friends' homes. If you're using your vehicle, you can likely anticipate how much the additional cost may be based on what your current fuel efficiency is like.

If you're planning to have your child rely on public transportation, the costs are different.

Bus Pass

A monthly bus pass in Canada costs near $100 in many provinces, but the costs do vary based on your location. The TTC for example which runs in Toronto is expected to increase yet again $122.50 in 2022.

If you're planning to ride the bus with your child, that's an additional cost to cover. It's important to know local laws surrounding this topic as well.

In Canada, three provinces (New Brunswick, Quebec, and Ontario) have age requirements for when children can be left alone. This includes being alone to ride the bus.

School Bus Fees

Some locations require a school bus fee for yellow buses that will take your child directly to and from school. Not all provinces have these fees.

For instance, in Calgary, Alberta, the fee for school buses has just increased to $465 or $800 for families.

School Associated Costs

No matter where you live, there will be costs associated with schooling. Since your child is in school for many years, the costs will change as they get older.

Laptops and Tablets

Some schools will provide these devices to your child for use, while others may require families to purchase them on their own.

The best budget laptops range from $200 to $800.

Purchase these items at secondhand locations, like Craigslist, eBay, Kijiji, or a local electronics store. The cost for a used laptop can vary greatly based on the company that made it or the year it was made.

Supplies

Children typically need more school supplies when they are younger, including pencils, scissors, glue, crayons, and tissues. Expect to pay near or more than $650 for younger children's school supplies.

As they get older, they may need books, backpacks, or electronics to keep up with their requirements, but these vary from school to school.

If you're unsure about whether you can afford these supplies, consider shopping at dollar stores. You will often be able to find what you need at a much lower cost.

Online Memberships

One of the parental expenses in Canada that is often forgotten is online memberships for students. These memberships provide additional opportunities and skills to children, but they come at a fee depending on the membership you choose.

An example of this is ABC Mouse. This service costs $79.99 per year.

Another option is Learn With Homer. This online early learning membership is usually priced at $119.88.

School Trips

While the school may cover some of the costs of school trips, if they don't have the full cost in their budget, your family may be asked to pay for your child's participation.

These fees will vary depending on several factors, including the average socioeconomic situation for families in your area, the type of trip it is, and more. Without additional payment, however, your child may be left out of the fun.

Some examples of school trips include:

- Museums

- Nature areas

- Aquariums

- Amusement parks

- Educational tours

While the school may cover some of the cost, the average cost for a child's ticket to a museum, like the Canadian Museum of History, is $11 for children 8-12 years old.

Summer Camp

This is not a necessity for families, but it can be a great way for your child to get exposure to different experiences and learn new skills or hobbies. It's also a wonderful chance for socialization and making friends.

There are options for a summer camp that are either far away from home or local, regardless of where you live in Canada.

Local options may be less expensive because they require less travel, but the fees to attend could still be higher. Farther away options, such as those in northern or southern Canada, could face the opposite problem.

Kawkawa Camp, as an example, costs $455 for youth camps and junior teen camps.

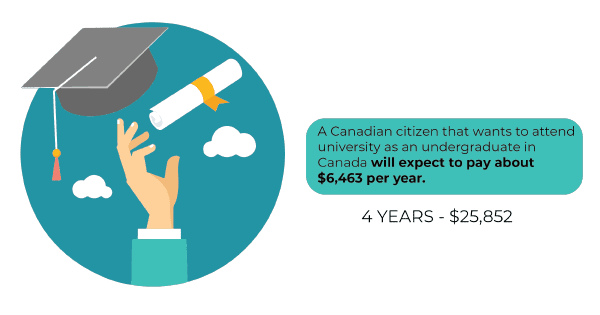

Saving for University

Another one of the big Canadian parental costs is saving up for university. While not all children will attend university, many Canadian parents want to save for this expense because it is a large expense, and not preparing beforehand can cause a lot of stress.

A Canadian citizen that wants to attend university as an undergraduate in Canada will expect to pay about $6,463 per year. At the time this article was updated in March of 2022, that cost has raised to an average of $6,693 for undergraduate programs. Now fast forward to the year 2035, and parents can expect to pay a staggering $17,200 per year for their kids to attend university.

What are the options that you have? How can you possibly afford to save this much with the cost of everything else?

Some parents will choose to open a Registered Education Savings Plan (RESP) for this purpose, which is a specific savings account for a child's education following high school.

Other Expenses for Raising a Child

While the obvious costs we have already discussed are clear, there are others that parents to be often overlook.

Birthday Parties

How much do you think the average first birthday party costs for a child? The answer is anywhere from less than $50 to over $500.

Of course, not all parents will spend the same amount on these parties every year, but it's a cost that many parents don't often consider. $500, even once a year, is a lot of money for many families. More to that your child is likely to be invited to a few birthday parties a year so factor in an additional $100-$200 in gifts for other children.

Extracurricular Activities

If your child grows up to be involved in activities, like dance, baseball, or hockey, these will cost some money. You may have to pay for your child to be able to participate at all, but you'll also have to cover fees for travel to tournaments, costumes or gear, and more.

The average family will spend around $1,160 on hobbies and extracurricular activities. At the time of review, this number is unchanged for now.

Babysitting Fees

The average rate for a babysitter in Canada is about $14.54 per hour. It has gone up slightly in recent years. More to that, as of January 1, 2022 the rate of minimum wage increased $15.00 per hour so that's the recommended starting wage for any babysitter.

As a new parent, you'll likely need some time away from the baby from time to time, and hiring a babysitter may be something you do more often than you think. This cost can add up.

Know the Cost of Raising a Child in Canada

Overall, it's clear that the cost of raising a child in Canada can be pretty high for most families.

When this article was written, children cost about $13,365.63. This means that the average cost of raising a child per month is about $1,113.80. In 2022, average cost ranges between $10,000-$15,000 a year.

If you want to have a child, you need to be prepared financially. What is the best way to do this?

At Insurdinary, we have many financial planning and personal finance resources available to you. Check out our blog to learn more!