Many people feel there is no need to have a will. As people age, they don’t want to contemplate their own death. According to a survey by Angus Reid Institute, 51% of Canadians do not have a Will, and 35% of Canadians have a Will that is not up-to-date.

If you die in Canada without a will, you have died intestate. When that happens, you won't have any control over how your assets are distributed. The only way to prevent automatic distribution of your assets after you pass is by having prepared a Will and Last Testament.

Epilogue Wills is a virtual estate planning company that provides a simple solution for Will and Powers of Attorney creation at a fraction of a cost compared to hiring a lawyer. In this review, we will go over services offered by Epilogue Wills and discuss their benefits and drawbacks.

Disclaimer:

All, or some of the products featured on this page are from our affiliated partners who may compensate us for actions and or sales completed as a result of the user navigating the links or images within the content. How we present the information may be influenced by that, but it in no way impacts the quality and accuracy of the research we have conducted at the time we published the article. Users may choose to visit the actual company website for more information.

What is Epilogue Wills?

Epilogue Wills, or just Epilogue for short, was co-founded by Daniel Goldgut and Arin Klug, two estate attorneys who worked in the traditional legal market. Their desire was to devise a process for people to protect their interests in a convenient and affordable manner.

The result is Epilogue, where you can develop Wills and Powers of Attorney right from the comfort of your own home.

It only takes about twenty minutes for you to create a legally binding Will or Power of Attorney document using their online platform. Answer a few questions and the Epilogue software generates a custom document based on the information you provided in accordance with laws of your province of residence.

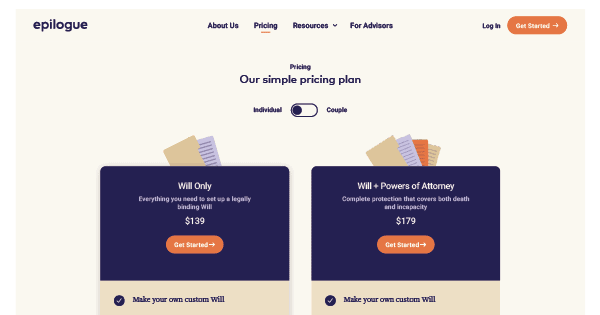

Will Only Plan

When you select the “Will Only” plan you will get one customized Will. Within the Will, you can specify how you want your assets distributed upon your death and you can designate guardians for your minor children. You are also able to state your funeral and burial wishes.

The cost for the “Will Only” plan is $139 per person, or $229 for a couple.

This plan allows you to:

- Plan your estate and allocate assets and property

- State funeral and burial wishes

- Choose a caregiver for your minor children and plan for their inheritance

- Access Epilogue’s educational blog

- Make unlimited changes to your Will for free

Will and Power of Attorney

Under this plan, you are able to create both a Will and two Powers of Attorney to handle your financial and medical needs in the event you become incapacitated. POA designates a person you trust to handle financial and/or medical decisions for you in an unfortunate event if you become unable to care for yourself or make sound decisions. If you're interested in finding out more about Powers of Attorney, take a look at our detailed breakdown.

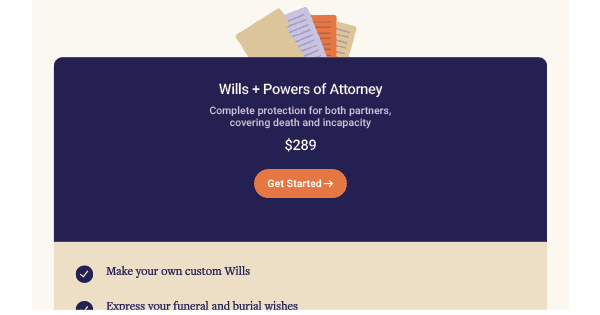

The cost for this plan is $179 per person or a couple’s bundle is available for $289.

This plan includes:

- Plan your estate and allocate assets and property

- State funeral and burial wishes

- Choose a caregiver for your minor children and plan for their inheritance

- Access Epilogue’s educational blog

- Ability to make unlimited changes to your Will and Powers of Attorney for free

- Plan for medical care if you become unable to make medical decisions on your own

- Designate a person you trust to manage your finances and property if you become unable to do so

Can You Trust Epilogue Wills?

The short answer is yes. Epilogue Wills has strong security measures in place for protection of your personal information. Bcrypt technology avoids security breaches by making passwords “hashed”. This means the information is scrambled within the software using encryption so it can only be accessed by the authorized user.

Sessions are managed on a secure HTTPS protocol. All data is transferred using Transport Layer Security (TLS) and is stored in encrypted storage volumes that are backed up on a Virtual Private Cloud (VPC). They use dedicated firewalls in Canadian data centres.

Payments are processed through Stripe, which carries the highest level of PCI certification available within the industry of payments processing. They utilize the highest in-class practices and tools to ensure security.

But don't forget about personal security measure either. It is important for you to print and store your documents safely. They are sensitive documents that your loved ones will need to access at the appropriate time, so they are best stored in a personal safe or safety deposit box.

Benefits of Creating Online Wills

When using Epilogue Wills you have the benefit of a fast turnaround. Rather than waiting weeks for an attorney to create a Will or POA, you are able to create these documents yourself in about twenty minutes.

You will be avoiding the high cost of an attorney, while getting legally binding documents that conform with the laws and regulations of your province.

As you progress through life there will likely be the need to make changes to your estate documents. These are free with Epilogue as you can make unlimited edits and revisions.

The Drawbacks of Epilogue

Currently, Epilogue is only available in Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Saskatchewan and PEI . Unfortunately, the service is not yet available in other provinces.

When you strive for simple, online legal documents, there are bound to be certain drawbacks. For instance, you will not be able to receive in-person service, because this is an entirely virtual experience.

You will be responsible for printing your own documents and coordinating their signing by two witnesses to ensure the documents are valid.

If your wishes and situation are complex, using Epilogue may not be suitable. When your situation requires specific inclusions in your estate documents, you will want to consult with an estate attorney. The situations where you should hire an attorney include:

- You need to comply with a separation agreement regarding the allocation of assets

- You need to have custom clauses or documents included in your will

- You plan to include a Henson Trust in your estate plan

- You are appointing an out-of-province administrator for your estate

- You have complex assets, including foreign bank accounts or property

- You want to use dual wills for the purpose of lowering estate administration taxes that the estate must pay upon your death

However, the list above describes rare circumstances. If they do not apply to you, Epilogue Wills provides more than adequate services.

How to Create a Will and Power of Attorney

By following these simple steps you will have your Will and Powers of Attorney in your hands within minutes:

- Identify your province— Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Saskatchewan and PEI.

- Answer questions about your marital status and dependents

- Epilogue will use your responses to recommend a plan for you

- Select the plan you desire

- Input personal information, including name, email address, and create a username and password for accessing the Epilogue dashboard

- Complete your application, which includes:

- Family information—additional information regarding your marital status, details about your children, appointed legal guardians, and pets

- Property and assets—list each item with your intentions regarding their distribution

- Designate the executor of your will, a person to make healthcare decisions on your behalf if you are incapacitated, and a person to handle financial decisions, and list your funeral wishes

- Submit your application and pay online

- Print your documents

- Sign all documents in front of two witnesses

- Store original copies in a safe place, such as a personal safe or safety deposit box

- Make sure your executor and person with Power of Attorney know how to access the documents

- Review the documents periodically and make any necessary changes—each time changes are made you will need to re-print and sign before witnesses

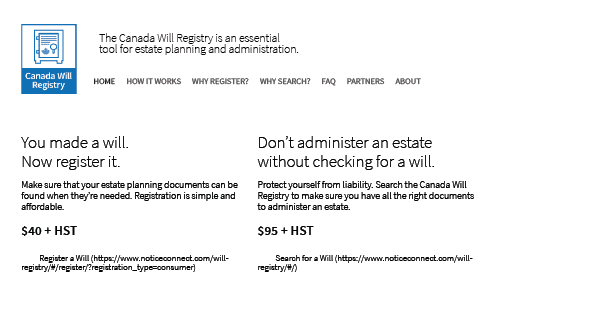

What Does Canada Will Registry Do?

To ensure the execution of your Will upon death, you can register it on the Canada Will Registry.

By registering your Will at the Canadian Will Registry for $40, you ensure that your estate plan can be found when you die, in case your family of lawyer cannot find access to your documents.

Upon your death, your family or attorney will be able to submit a search query at the Canada Will Registry. If the search results in a match to a registered Will, and if the searcher has the right to know about the will, they will receive a notification of a match. The searcher will only receive information if they are able to provide a valid death certificate.

The reason you want to register your Will is because of the length of time that may pass between when you write it and when you die. When your family or attorney are unable to locate the Will, the law will distribute your assets according to the intestate laws of your province.

Insurance as Part of Your Estate Plan

Funeral expenses in Canada are substantial. Cremation fees range between $500 to $5,000, a casket and burial are over $3,000, and a funeral including a reception can be over $10,000.

Consider, Funeral Insurance to pay for those expenses. By paying a premium for this insurance you maintain coverage until you pass away, at which time the insurance provider pays out your family to cover funeral costs. This saves your family from having to pay thousands of dollars out-of-pocket.

When you purchase Life Insurance it provides financial security to your loved ones after you pass away. Your insurance provider can assist you in determining the appropriate amount of coverage depending on your specific situation. This includes whether you are single or married and whether you have children.

The money your family receives after you pass can assist them in paying debts, mortgage payments, and general everyday expenses. The cost of this coverage will depend on the size of the policy you purchase and the term length of the benefits you select. Our agents would be happy to assist you, get a quote today.

Is Epilogue Wills Worth It?

Epilogue Wills will provide you with the security of having an estate plan in place. Their service is reliable and straightforward. If you live in one of the five provinces covered by Epilogue Wills and are not under any circumstance that would make creating a Will or POA a more complex process that would require spending a considerable amount of money on a lawyer, then Epilogue is the ultimate solution for your estate plan needs.