Did you know that 57% of Canadian internet users experienced a cybersecurity incident?

With the current health crisis, cybercrimes became more rampant. This is why you must protect yourself whenever you’re browsing the internet now more than ever. However, what should you watch out for?

Among hacking and scams, identity theft cases are also on the rise. Read our comprehensive guide and learn how to protect yourself from cybercrime.

Disclaimer:

All, or some of the products featured on this page are from our affiliated partners who may compensate us for actions and or sales completed as a result of the user navigating the links or images within the content. How we present the information may be influenced by that, but it in no way impacts the quality and accuracy of the research we have conducted at the time we published the article. Users may choose to visit the actual company website for more information.

What is Identity Theft?

Identity theft refers to the crime of stealing someone’s information to commit fraud. Cybercriminals employ various methods to commit identity theft. They leave their victim with damaged finances and reputation. With technological advancements, these criminals commit identity theft on a wider scale.

Hacker tactics include phishing, malware attacks, and even dumpster diving.

What is Identity Fraud?

Often, identity theft and identity fraud are interchangeable terms. However, stealing information differs from using it to gain something through illegal means. The fraudulent activities criminals commit is a long list.

These crimes include:

- Credit card fraud

- Tax-related fraud

- Utility fraud

- Bank fraud

- Loan or lease fraud

- Government benefits fraud

The most insidious among these is criminal identity fraud. This is when someone takes another person's identity while committing a crime.

What’s the Difference Between Identity Theft and Credit Card Fraud?

The primary difference is that credit card fraud only affects a victim’s open accounts. It happens when thieves get a victim’s credit card information. They use various methods like skimming devices at an ATM outlet.

Credit card fraud can have lasting effects. It’s not the same as stolen identity, but the financial ruin it brings can become debilitating. If you don’t discover it fast, it will ruin your credit score.

The good news is that it’s easier to stop than full-blown identity theft. It’s also easier to recover from it.

Why Having Identity Fraud Protection is Important

One of the biggest data breaches in Canada happened between 2017 and 2019. It compromised the personal data of almost 9.7 million Canadians. This happened with Desjardins, the largest credit union federation in North America.

Due to a security gap, first and last names along with social insurance numbers got stolen. The worst part is that it didn’t happen because of a complex hacking scheme. An employee unwittingly provided data access through a shared drive.

Worse, over 52% of Canadians can’t identify all warning signs of identity theft when presented with a list. To be safe, you need identity theft protection services. These work by tracking your credit and scanning the dark web.

Protection services will alert you if your information falls into the wrong hands. In case of credit card fraud, these providers can lock or unlock your credit reports. They can alert you whenever someone uses your name to apply for credit.

What is the Most Common Form of Identity Fraud?

The most common identity theft scheme involved stolen debit or credit card. Criminals committing these crimes often use card cloning to get personal data. It happens in almost 40% of identity theft cases in Canada.

How Do I Prevent Identity Theft?

To stay safe from identity theft, ensure that each family member knows the precautions below.

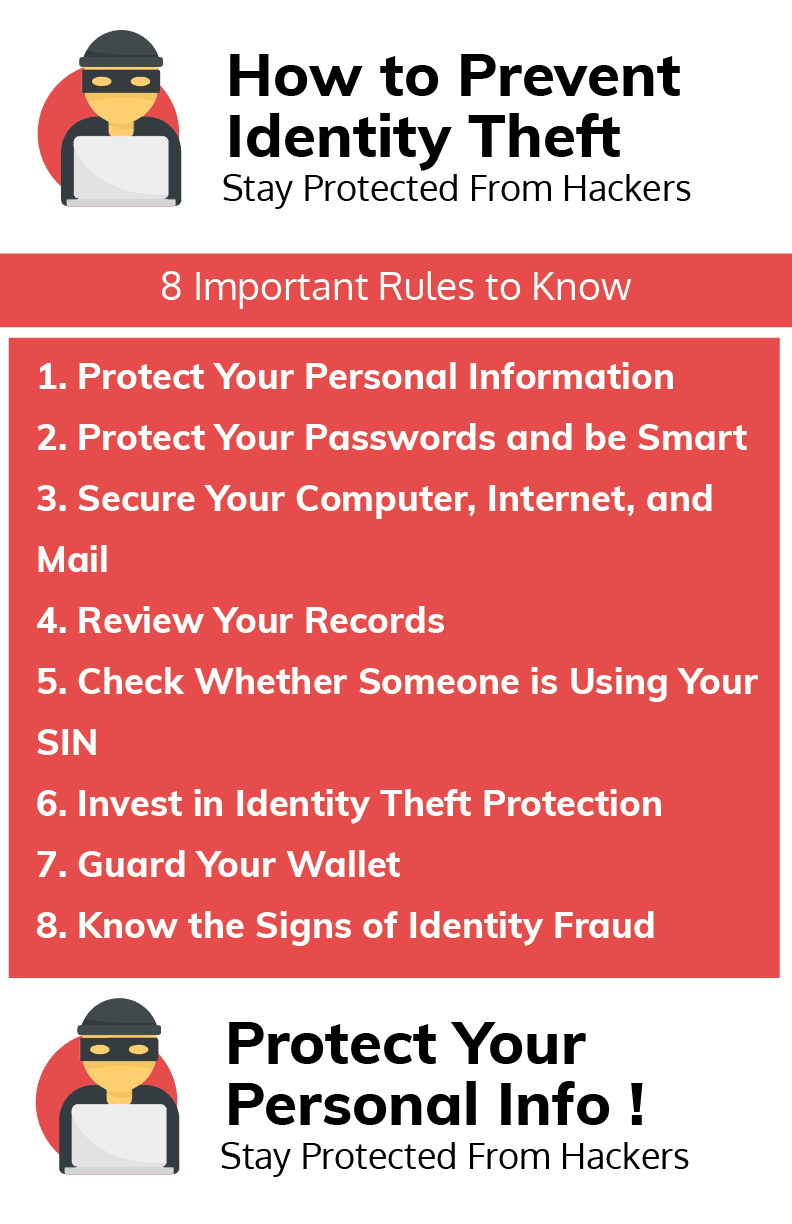

1. Protect Your Personal Information

Never Provide your personal information online unless you fully trust the website. This is crucial for your SIN and credit card numbers.

When you buy items online, look whether their website is secure enough. A good indicator is the “HTTPS” prefix in their URL. It also comes with a padlock icon.

2. Protect Your Passwords and be Smart

Avoid using one password for your credit, bank, and telephone accounts. Never write them on paper or tell other people about it. Limit the credit cards and information you carry to the essentials.

3. Secure Your Computer, Internet, and Mail

Your computer must have an active firewall. It prevents other people from accessing your computer data. When buying online, deal with established companies. Make use of data encryption technologies that improve your security.

4. Review Your Records

When your bank and credit card statements arrive, check them. If you see discrepancies, report them to the authorities. It might be an indicator that one or more accounts are compromised.

Also check your credit report and credit score. Do this at least once a year to ensure their accuracy since you might fall victim to credit card fraud.

5. Check Whether Someone is Using Your SIN

The good news is that the Canada Revenue Agency sends a Notice of Reassessment after tax season if the numbers reported to them do not match your tax return. It will shed light on if someone used your SIN for employment or tax purposes. The bad news is that you'll have to further deal with the CRA to clear the air.

6. Invest in Identity Theft Protection

Identity theft protection services, that regularly check your credit score and report for you, can be costly at around $20 a month. However, if you would like to save some money, Mogo is a great option. They use bank-level encryption to protect your personal information and alert you to any changes in your credit.

Get your Risk Free Identity Protection today!

Canadian Identity Theft & Credit Protection Services

Get protected today7. Guard Your Wallet

Identity thieves often prey on lost or stolen items that contain personal information. If you carry your wallet around, avoid bringing your SIN card unless absolutely necessary.

Do this for all your other IDs and credit cards. Leave them at home in a secure drawer or safe if you aren’t using them. That way, you won’t fall prey to people who might follow you around, waiting for opportune moments to steal your information.

8. Know the Signs of Identity Fraud

Knowing whether someone stole your identity is important to prevent it from repeating. Never let it come to a point where you get unexpected denials because of a credit check. Your main objective is to look for errors or strange activities.

If bills or statements don’t arrive, it might mean that someone stole them from your mailbox or changed your accounts’ mailing address.

Another sign is when you receive calls from creditors or other collection agencies. If they talk about an account you do not know of, it’s likely because of identity theft. Luckily, your bank or credit card company should notify you about a new account using your name.

Check your account statements often. This will provide proof for you of transfers or withdrawals without your knowledge.

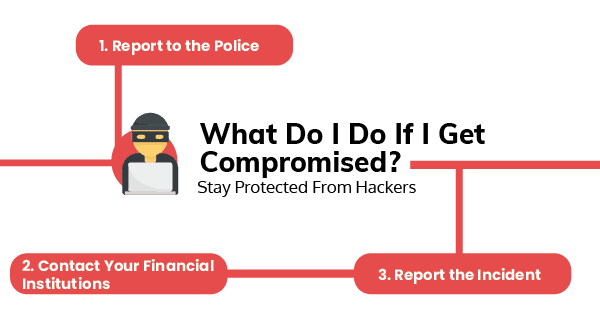

What Do I Do If I Get Compromised?

Now that you know the signs of identity theft, it’s time to find out what to do if you become a victim.

Here are steps you must take:

1. Report to the Police

When you do, get a police report copy. Share it with your credit card issuers and credit reporting agencies. Do this for other companies and financial institutions that you deal with.

2. Contact Your Financial Institutions

Talk to the financial institution that made the errant money transfer. Report the incident to them to ensure that they’re aware of your situation. Additionally, place flags on every account you own.

Change your passwords, even for accounts you hardly use. After that, report the fraud to Equifax and TransUnion. Present the police report as evidence that you did your due diligence

3. Report the Incident

Contact the Canadian Anti-Fraud Centre using their hotline or their website. Other organizations can get involved depending on the type of identity fraud committed. Here are some additional considerations:

Website Fraud

Report the incident to the website administrators. It applies when another party commits the fraud while both parties use the online platform.

Redirected Mail

If you suspect your bills got redirected, contact the Canada Post for clarification. At the same time, get in touch with your service providers. Tell them about the identity fraud incident.

Stolen Social Insurance Number

If someone stole your SIN, visit a Service Canada Centre. Provide all required documents to prove that fraud or misuse of your SIN happened. Alongside this, provide an original copy of documents proving your identity.

Consequences of Identity Theft

The good news is that identity theft is a heavy crime in Canada, punishable by up to 10 years worth of imprisonment.

The judge will not always impose the maximum sentence after delivering a verdict. Regardless, the defendant gains a criminal record. On its own, it can have a negative impact on their life forever.

A convicted identity thief will have a harder time getting a job. Sometimes, they get travel restrictions too. It depends on the severity of the crime. As for minimum penalties, this crime has no mandatory minimum punishments.

Canadian courts can decide to make an offender pay restitution to the victim. This money is to help the victim rehabilitate their identity. This means replacing credit cards and documents and fixing their credit history.

How Does the Crown Attorney Decide?

Identity theft is deemed as either a summary offense (worth two years of imprisonment and $5,000 fine) or an indictable offense (up to 10 years of imprisonment). When deciding the type of offense, the Crown Attorney considers the value of losses. If the losses are bigger than $5,000, the Crown will likely decide that the offense is indictable.

Does the Police Investigate Identity Theft?

Canada counts identity theft as a Criminal Code offense. It means the provincial or municipal police must investigate and enforce these laws. Local police use their crime or fraud units to investigate these cases.

Avoid Becoming an Identity Theft Victim Today!

There's no room to be lax in a world centered around technology. A small data breach or weak password can lead to a huge loss of personal data. You absolutely need to prioritize your data security.

Identity theft methods evolved to exploit the digital age and lack of user education. Use this guide to educate and arm yourself against cyber-threats and attacks. If you think your accounts got compromised, contact your financial providers at once.

To further protect your finances from unexpected events, consider getting insurance. As Canada's top financial comparison platform, we'll provide you with the best insurance quotes for your needs.