Imagine you just landed the job of your dreams, and you're ready to fill out paperwork and start your career. First, you need to make sure you know your Simplii Financial transit number and other information.

That way, you can set up direct deposit so that your employer can pay you on time. And you can make sure you have the money you need for bills and other payments.

Keep reading to learn about your Simplii Financial bank numbers.

Disclaimer:

The content in this article or page is for informational purposes only. While we only conduct the most thorough research and evaluations, and update our content continuously, we cannot guarantee 100% accuracy of the details shown. Users may choose to visit the actual company website for more information.

Banking Numbers You Should Know

When banking with Simplii Financial, you should know some essential numbers. That way, your transactions can be successful, both for incoming and outgoing funds. Your transactions will require the following:

- Institution Number

- Transit Number

- Routing Number

- Account Number

Using these numbers will help you conduct transactions easily and accurately. That way, you can stay on top of your finances.

Institution Number

Like other banks in Canada, Simplii Financial has an institution number that differentiates it from other banks. Transactions that occur between different banks require the institution number for both to help facilitate the transfer.

Knowing the institution number of both banks is essential for a smooth exchange. However, you should at least know the Simplii Financial institution number for your side of the transaction.

You can use the number to make the process quicker without sacrificing accuracy. In Canada, bank institution numbers are three digits long, and they're part of the overall routing transit number (RTN).

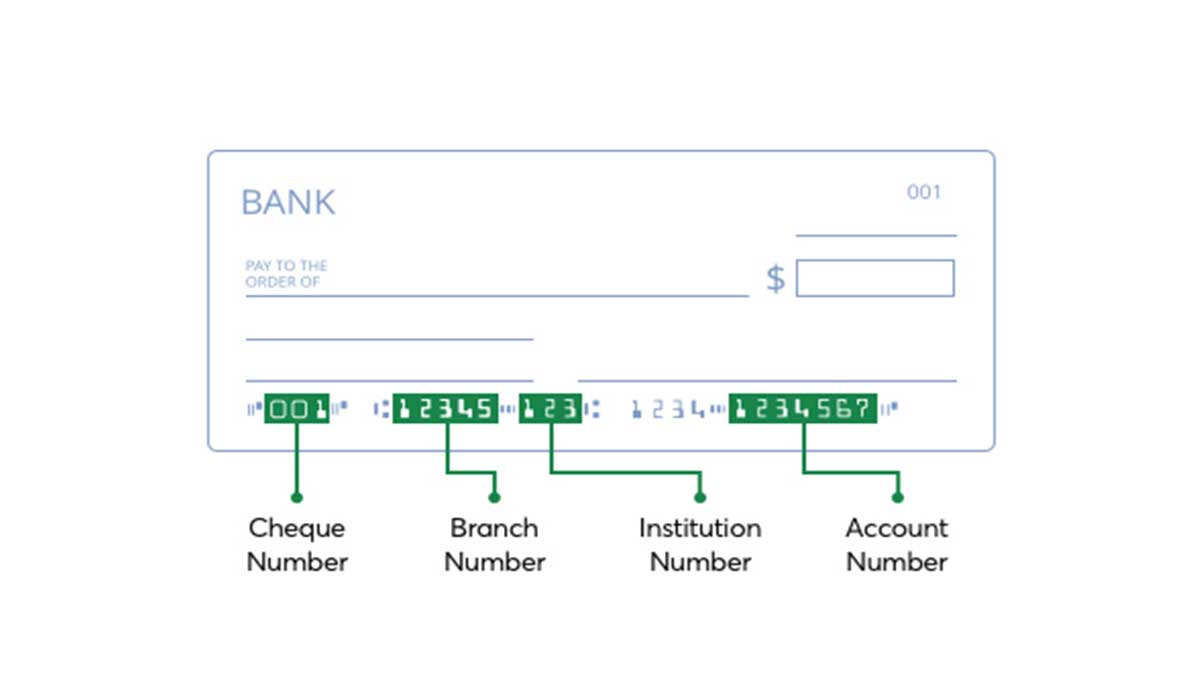

You can find the Simplii Financial institution number after the cheque number and the branch or transit number. The three-digit number 010 is the institution number for Simplii Financial.

If you have a cheque book, you will be able to find this number at the bottom as part of the MICR line.

Transit and Branch Numbers

Another important number to know is the Simplii Financial transit number or branch number. While some banks have individual numbers for different locations, Simplii Financial only has one transit number.

The transit number for all Simplii Financial banks is 30800. You'll use this number for transactions with accounts at Simplii Financial and other banks.

Even though the number is the same throughout Simplii Financial, it's another number that helps locate your account. Then, you can make sure money comes from the right account or goes into the right account.

You can find the Simplii transit number on the MICR line with the institution number. If you ever need to give out this number, it will be easy to access.

Bank Routing Number

The Simplii routing number is another vital part of your banking numbers. Simplii Financial is part of the Canadian Imperial Bank of Commerce (CIBC), so it shares the same routing number.

Your Simplii Financial routing number is 001044331, and you'll find it at the bottom of your cheques.

As with other banks in Canada, the routing number combines the transit and institution numbers. However, a routing number also has a leading 0, for a total of nine digits.

The Simplii Financial routing number is a bit different because it doesn't include the exact transit number. Still, it follows the same format as other banks:

- Leading 0

- Institution number (010)

- Transit number (44331)

You can use this number for electronic or paper transfers. In some cases, a paper cheque may list the transit number before the institution number and without a 0 at the front.

Account Number

While the transit, institution, and routing numbers are important, your account number also matters. Without it, you won't be able to send or receive money properly.

You can find your account number at the bottom of your cheques next to the other numbers. This number will be unique to you and that account.

If you have multiple chequing accounts, knowing this number will help you select the correct chequebook. Even if you only have one chequing account, the number will also help you separate it from a savings account.

You'll need this number when setting up any incoming or outgoing payments. It also helps when you need to verify the balance of your account.

How to Find Your Bank Numbers

You can view all of your Simplii Financial bank numbers each time you look at your cheque book or write a cheque. Each number from the institution number to your account number will be at the bottom.

However, you will also see your cheque number at the bottom, so make sure not to confuse the two. You can look through your cheques to see the different cheque numbers to help differentiate them.

Unfortunately, you may not always be able to rely on cheques to find these numbers. Whether you run out of cheques or don't use them at all, you can still figure out your numbers.

Out of Cheque Books

When you don't have any cheques left, you can log into your online banking account. You can log in using a desktop or the mobile version, and you can view your:

- Account number

- Institution number

- Transit number

If you don't already use online banking, you can sign up by activating your debit card. After that, you will need the card and your password for telephone banking to register online.

No Chequing Account

If you have a savings account with Simplii Financial, you will follow the same steps as if you had a chequing account but no cheques.

You'll need to log into your online banking account and view the account in question. Then, you can see the account, institution, and transit numbers.

Knowing your numbers for a savings account is important if you want to transfer money to it. That way, you can still make sure the money goes to the correct place.

No Online Banking

While many people use online banking, not everyone does. If you don't have access to online banking, or you need your number and can't access your account right now, you do have options.

First, you can call Simplii Financial. They offer support 24 hours a day, so you don't have to wait to obtain your bank numbers.

During the day, you may also use a chat feature to message an agent for help. Simplii Financial chat agents are online are available:

- Monday through Friday from 7 am to 12 am ET

- Saturday, Sunday, Holidays from 9 am to 6 pm ET

If you have online banking, contacting customer service can be useful if you forget your password. But it's also useful if you don't have access to online banking.

You may want to void a cheque to keep on hand for when you run out. Then, you can access your cheques without needing to use the internet or contact anyone.

Why Are These Numbers Important?

Your Simplii Financial bank numbers are important for any transaction. Whether you write someone a cheque or need someone to pay you for a new job or side hustle, you should know your numbers.

If you don't give someone the correct set of numbers, you won't obtain your money as quickly. While you don't need to memorize the numbers, you should know where to find them.

Consider a couple of scenarios where knowing your Simplii Financial transit number comes in handy.

Outgoing Payments

Outgoing payments include anything that will debit your chequing account. You may want to set up payments for your rent, utilities, or other expenses.

Setting up these transactions is especially convenient for recurring payments. You will be able to preauthorize the transaction for this month and future months.

If you have a lot of bills and payments, doing this can save you time and worry. However, you will need to provide your institution, transit, routing, and account numbers when you set up a payment.

Incoming Payments

When you start a job, you may want to enrol in direct deposit for your paycheque. Direct deposit will allow your employer to automatically deposit your earnings into your account on payday.

You'll be able to use the money for bills or other outgoing payments, but you won't have to visit the bank to cash or deposit the cheque yourself.

If you work for yourself, knowing your numbers can also be useful. Your clients may want to set up a direct deposit to help simplify payments for both parties.

Other Transactions

You will need your bank numbers for any bank transaction, even one-time payments. The same is true if you ever need to wire money or receive a wire transfer.

When paying or receiving money from someone else, they may need your account information. Make sure you only give out what the other person needs and only do so to people you trust.

Unfortunately, there are many scammers out there. If they obtain your numbers, they may be able to pretend to be you and conduct transactions that you don't authorize.

It's easier to prevent the situation from the beginning than to catch the scammer later. While you should know your numbers, be careful who you give them to.

Reviewing Your Simplii Financial Transit Number

Simplii Financial is a great bank for Canadians, but that doesn't keep you from needing to know your bank numbers. From your Simplii Financial transit number to your account number, you should keep these numbers safe.

Then, you can access them when you need to set up a payment. But you don't have to worry about scammers obtaining the numbers so that they can commit identity fraud.

Do you need a new chequing account? Visit Insurdinary to compare the best accounts in Canada.