What if you didn't know some of the most important dates for the upcoming year?

If you are part of a low-income family in Canada, then you likely take advantage of the goods and service tax. This program helps to provide financial assistance across a series of payments.

But when will you get your money? What are the GST payment dates 2022 and 2023, and what else do you need to know about this program? Keep reading to discover the answers!

What Are the GST Payment Dates 2022 and 2023?

Qualifying recipients only receive GST payments four times per year. And that brings us back to the big question: what are the GST payment dates 2022 and 2023?

In 2022, the payment dates are as follows and are based on your 2021 return:

- January 5, 2022

- April 5, 2022

- July 5, 2022

- October 5, 2022

And in 2023, the payment dates will be as follows and are based on your 2022 return:

- January 5, 2023

- April 5, 2023

It may go without saying, but pretty much all qualifying applicants for the GST credit are on a very strict budget. We suggest carefully memorizing these payment dates and crafting a personal budget that takes these dates into account.

And if you don't have a great head for memorizing specific dates, concentrate on memorizing the payment months instead. As you can tell, the vast majority of payments pay out on the fifth day of each payment month.

In all likelihood, if you are receiving GST Payments, you are receiving them through direct deposit or possibly via cheque delivered to your home address. Either way, it's wise to have a CRA My Account. A CRA My Account allows you to view your benefit amounts and information and any important updates related to them. If you don't already have a CRA My Account, here is a step by step guide on how to register for one.

What Is the GST/HST Tax Credit?

Our guide is going to help you figure out the key dates and other important info related to the goods and service tax. Before we go any further, though, we need to answer a more fundamental question: what, exactly is GST?

As we already noted, GST is an acronym for "goods and service tax." This is a tax that Canadians pay for the vast majority of goods and services, and GST as we know it was put into place back in 1991.

However, the Canadian government understands that these taxes are hard on families with low or modest income. To help offset this, they offer a special GST credit to those who qualify.

The GST credit program comes in the form of quarterly payments. Therefore, those who apply and qualify can receive four special payments from the Canadian government each year.

Our guide is going to walk you through key information, including how much money you are likely to receive based on your income and other factors. Additionally, you may be able to receive extra money on these payments based on your location and the programs you take part in (such as the Canadian Greener Homes Grant program).

This credit program has been very successful, and it helps over 12 million Canadians receive payments each year. But because these payments only happen once per quarter, it's important to know what these exact dates are.

GST/HST Credit Eligibility Requirements

At a glance, the GST credit may sound amazing. After all, who doesn't want to receive free quarterly payments from the government?

In reality, the Canadian government is very strict about awarding this money. It can only go towards qualified applicants. Fortunately, we have all the information you need about how to qualify!

First, and perhaps most obviously, you need to be a Canadian resident. This is not a program designed to help visitors to the country, even if they end up being long-term visitors. Beyond this, there are different factors that may qualify you for the GST credit.

For example, you need to be 19 or older or be a parent that lives (or previously lived) with your child. Alternatively, you may qualify if you have a spouse or common law partner. Regardless of how you qualify, you also need to have a social insurance number to sign up for the program.

Right now, you may be thinking that almost all adults in the country would qualify for this program. However, there are also income requirements that our guide will review. So it's possible for someone to qualify at one point in their life and then not qualify at a later point because they are making too much money.

And, of course, there are some people who will never be able to qualify in the first place!

For the most part, the GST credit program is designed to be very inclusive. So long as you meet the income and other qualifications, then most Canadian residents can qualify. But there are some who will not be able to get these payments.

First, as we noted before, residency is a crucial factor here. If you are not a resident of Canada for the purposes of income tax, then you cannot receive these payments.

Second, speaking of taxes, this program is limited to those who pay taxes. That means that foreign officers and servants who don't pay taxes to the Canadian government cannot get GST payments. This also extends to their employees and their families.

Finally, you cannot receive payments if you have been in jail or another type of correctional institution for a period of 90 days or more.

Now, these things disqualify anyone if they meet these conditions at the beginning of a payment month. So someone who is sentenced to jail on March 1, for example, would still be able to receive their normal payment on April 5. But if they are still in jail by July, they would be unable to get the usual payment because they would now have been in prison for 90 days or more.

How Much Is The GST/HST Credit?

There is a lot of confusion over the payment amounts you will receive for the GST credit. This is likely due to the fact that the program has strict income requirements (more on this soon). However, those who qualify are not only on a fixed payment schedule, but they will receive payments based on marital status and the number of children (if any) as well as income.

For instance, a single person who qualifies for the credit can expect to receive maximum quarterly payments of $456. Somebody who is married or has a common-law partner can expect to receive maximum payments of $598. And those with children will receive a maximum of $157 for every child under 19 years of age who still lives in the house.

If this isn't obvious, the government gets this information about you (such as your marital status and number of dependent children) when you fill out your taxes each year. It's important to be accurate about this information and to file your taxes on time. After all, refusing to pay your taxes will keep you from taking part in the tax credit program!

Maximum Income for GST/HST Credit

The biggest restriction when it comes to qualifying for GST is your income. This has led many Canadians to wonder "how much income is too much to qualify for GST?"

The answer to this question is something of a moving target. That is because these amounts are periodically updated by the Canadian government. And as you might expect, the qualifying amounts change based on marital status and how many dependent children you have.

For example, those who are single and have no dependent children must currently make $48,012 or less to qualify for the GST credit. If that same person has one dependent child, he must make $53,992 or less. And if he has two children, then he must make $57,132 or less.

Should that same single person have three dependent children, he must make $60,272 or less. And if he has four dependent children, he must make $63,412.

Interestingly, the qualifying amounts don't change that much for those who are married or who have a common law partner. If such a couple has no children, then the qualifying income is $50,852 or less. But the qualifying incomes for those with dependent children are the exact same regardless of marital status, so couples can refer to the same numbers above if they have children.

By the way, always check to see how these credit programs will interact with things like your pension!

How Is The GST/HST Rebate Calculated?

Previously, we discussed the maximum amount that qualified applicants can receive from these programs. In reality, most applicants don't get the maximum amount. So, how does the government determine exactly how much you will receive for this credit after you qualify?

Basically, all qualified applicants start out with a base credit amount of $299. After that, you can get an additional $157 if the net income for your family is higher than $9,686. That's the good news.

So, what's the bad news? If your family income is greater than $38,892, the amount of credit you receive will be reduced by 5%. As your overall income increases, you can expect to receive less from the government via GST credit payments.

And it's important to keep an eye on your net income as the amount goes up. Once you hit the maximum income limits we outlined above, you will no longer be able to receive these payments. But if your financial situation takes a turn for the worst, you can always begin receiving payments again.

How to Apply for GST/HST Credit?

At this point, you might think that the GST credit sounds too good to be true. Furthermore, you might be asking yourself "how can I go ahead and apply for this?"

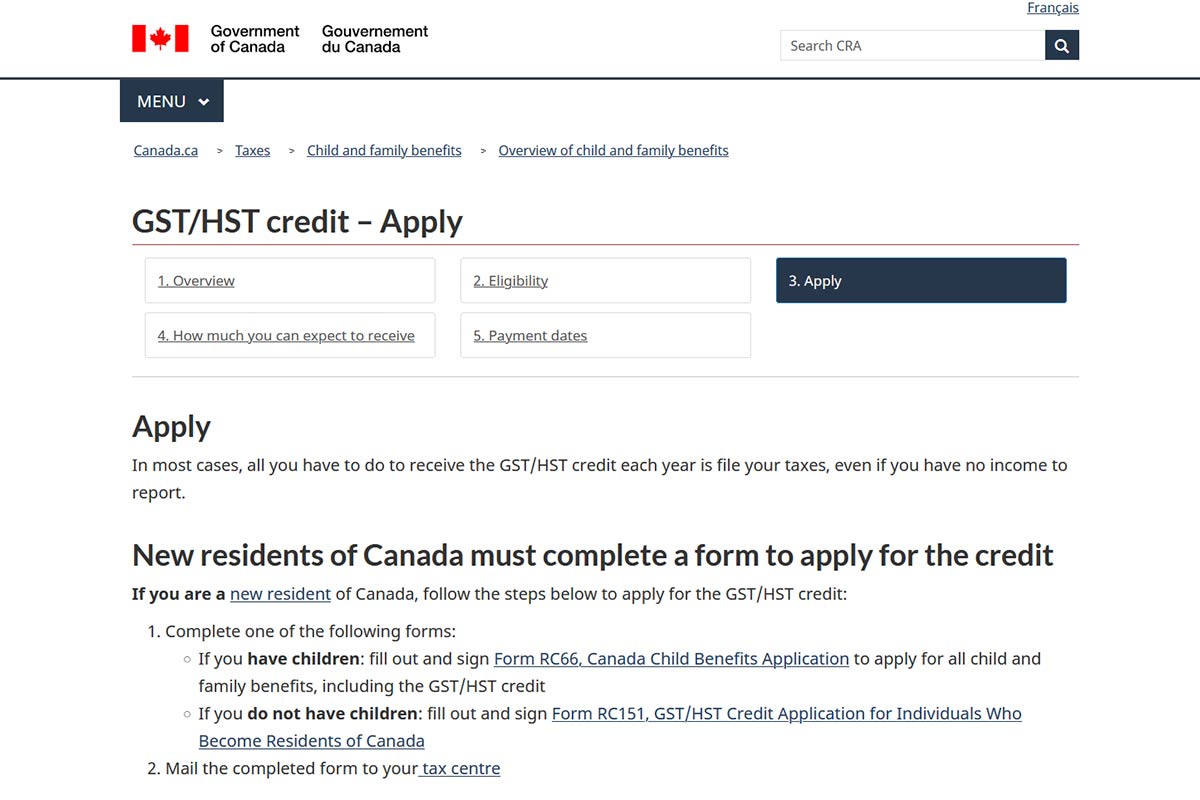

Fortunately, the Canada Revenue Agency monitors for qualifying individuals and goes ahead and signs them up. But they sometimes overlook people, especially if you are a relatively new resident and/or have no children receiving Canada Child Benefits.

GST/HST Credit for a New Child

If you are new to Canada and have children, you need to fill out Form RC66. After that, just mail it to the CRA tax office for your application to be considered.

By the way, it's never too late to look into affordable insurance plans for your children!

How Do Provincial / Territorial Programs Work with the GST/HST Program?

In some cases, you may be able to get additional money or benefits on top of the GST program. Different provinces have different programs, and you may already qualify for some.

For example, New Brunswick has a special harmonized tax credit that pays $300 to individuals, $300 to your spouse or common-law partner, and $100 per child (or if you are a single parent, $300 for your first child).

Meanwhile, Newfoundland and Labrador have an income supplement that pays $450 to individuals, $510 to married or common-law couples, and $200 per child. If you are a senior living in Newfoundland or Labrador, you may qualify for $1,313 whether you are single or in a marriage/common-law partnership.

And Nova Scotia has an affordable living tax credit that pays $255 to individuals, $255 to married or common-law couples, and $60 per child. In British Columbia, there is a climate action tax credit that pays $174 to individuals, $174 for spouse or common-law partner, and $51 per child (or $174 for your first child if you are a single parent).

Prince Island has its own sales tax credit that pays $110 to individuals and $55 to spouses/common-law partners as well as eligible dependents. And Ontario has a simple tax credit that pays a max of $316 per adult and per child in your family.

Yukon has a special carbon tax rebate that pays $176 to individuals, $176 to spouses/common-law partners, and $176 per child. Finally, Saskatchewan has a low-income tax credit that pays $349 to individuals, $349 for spouses/common-law partners and dependents, and $137 per child (for a maximum of two children). There is also a family payment of $972 available.

Now, this is on top of things like special senior benefits in Ontario. Long story short? It's always worth looking into what your province has to offer!

Newcomers to Canada GST/HST Application

If you are new to Canada and have no children, you can apply for this program by filling out Form RC151. Afterward, simply mail your completed form to the CRA tax office and you'll be good to go!

What Does Your Future Hold?

Now you know the GST payment dates 2021 and 2022, and knowing these dates can help you prepare for the future. But have you taken enough steps to prepare?

We specialize in helping Canadians get the insurance protection they deserve. To see what we can do for you and your family, come get a quote today!