Banking is usually a pleasant and simple experience, but there are scenarios in which suddenly they will require documentation you've never handled before. If you need to sign up for a direct deposit, set up automatic payments, or thought about investing, you may need to provide a void cheque.

If you're new to this kind of banking, you've probably never learned how to void a cheque. Fortunately, it's a simple matter that can be handled quickly!

It's also possible that you've made an error while writing a cheque, but don't worry. In just a few minutes, you can learn what makes a cheque void and the different ways you can obtain or make a void cheque.

Definition

A "void" definition is to invalidate or make not legally binding. In the world of banking, a cheque can be void, meaning it is no longer able to be used, cashed, or deposited. Literally, a void cheque is a cheque that has the word "void" written across the front of it.

When you void a cheque, it makes it impossible for anyone to use it as a form of transferring money from your account to anywhere else. This will protect you in the case of any fraud or malicious people who get their hands on your cheque.

A void cheque has a lot of uses that many people may never have encountered before. By voiding your check, you can be certain that it will only be used for your intended purpose.

Why Would I Need A Void Cheque?

Cheques contain all the necessary information that employers, banks, and other institutions need to set up payments with your bank accounts. It is a great way to prove your name, bank, routing number, and account number. However, handing over a blank cheque to someone is a risky business.

Voiding a cheque before you hand it over to anyone will make sure that the cheque is only used to transfer important information rather than your money.

The most important information taken from a cheque is a routing number and account number, so why do we need to provide a void cheque?

Simply, providing a void cheque is the easiest way to transfer this information with the least chance of error. Instead of having to read someone's handwriting or risk typos, a void cheque will be a proven, perfect document.

Preauthorized Payments

Preauthorized payments are one common reason why you may need a void cheque. Rather than remembering to send money every month, you can set up automatic payments from your bank account to pay for bills. This can prevent you from incurring late fees or losing your payments in the mail.

Many people choose to set up these payments for credit card bills, loans, and utility bills. To set up these preauthorized payments, the bank or company will ask for a void cheque so they can receive your accurate routing and account information.

Direct Deposits

Direct deposits are another common reason you may need to send a void cheque. Setting up direct deposits means you can get paid faster and more directly rather than receiving money in the mail and depositing them yourself.

Many payments are set up as direct deposits, such as payments from your employer or gains from investments. These companies will need your routing number and account number from a void cheque to make sure they set up this deposit correctly and don't end up paying someone else!

What if I Don't Have A Void Cheque for Direct Deposit?

Writing paper cheques is going out of style, and many people actually don't have cheques anymore. It's much more common to make payments or receive payments through debit cards or cash.

If you don't have a void cheque to offer, it's not always the end of the world. Many companies are flexible enough that they are willing to set up payments in a different way.

Because the most important information is the routing number and account number, you may be able to provide this information without it being on a cheque. You will just want to make sure the information you provide is completely accurate.

You may also be able to fill out a different form provided by the company or get a direct deposit form from your bank.

Paying for Your Insurance Products

You can pay for your insurance products by setting up automatic payments with a void cheque as well. Often, insurance companies won't accept credit cards and other forms of payment, forcing you to set up monthly withdrawals from your account instead. They will ask for a void cheque to get the correct account information from you.

How to Get A Void Cheque

There are a few ways you can get a void cheque so that you can set up payments or deposits. There are ways to get a cheque in person, online, and even through an app.

Online banking is taking over the world, which means banks have made it easy to set up direct deposits and automatic payments without even leaving your home. Many banks also have apps that let you perform your online banking needs through your phone. You can usually request cheques for your bank account in person, online, or over the phone to receive them in the mail.

If you go into your local bank, you can also request a counter cheque in person, from a teller at the bank.

How to Write A Void Cheque

Make sure you have a cheque for the correct bank account that you are looking to set up with the company. You can tell by matching the numbers on the bottom left-hand corner of the cheque to the account information you have in your bank documents or online banking.

How to Fill in A Void Cheque

The important information that a company needs to set up a link to your account is already filled out on the cheque. The routing number and account number are both printed on the bottom of the cheque.

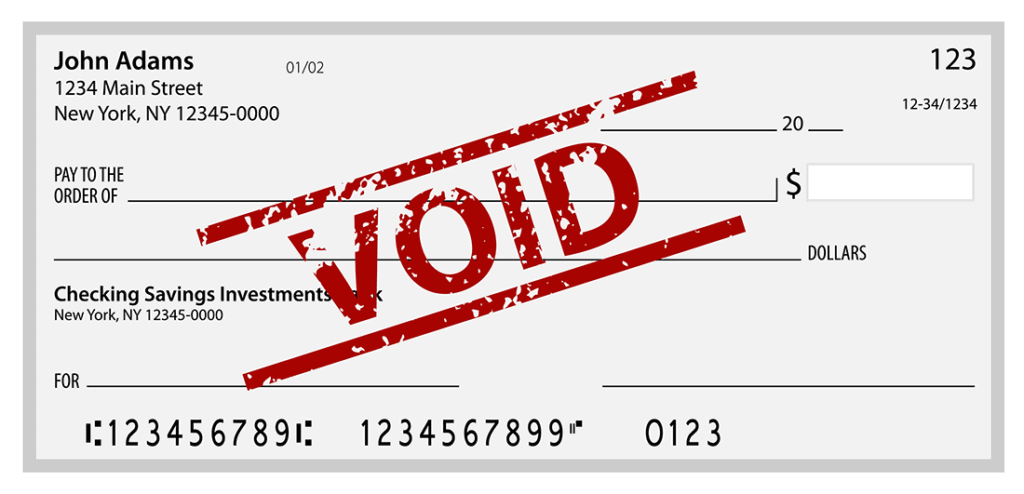

To void a cheque, all you need to do is find a dark pen or marker and write the word "void" across the front. You'll want "void" to be big and spaced out, covering the blank lines that you would typically use to write a cheque to someone. Now, no one will be able to fill in a dollar amount, date, or other information to attempt to use it.

If you want to try voiding a cheque online, you should look into what your online banking service offers. You might be able to get a virtual check with your account details or download forms that act as valid deposit or payment forms.

Do You Sign A Void Cheque?

You only need to sign a cheque if you are authorizing it to be used for the transfer of money. Because you are using a cheque to provide account information, not pay, you do not need to sign the void cheque.

How Do You Void A Lost Cheque?

It's a stressful situation if you lose a cheque because fraud happens all the time. Thankfully, there is a process you should follow to make sure nothing bad will happen.

First, you need to check to see if it has been used successfully. Write down the stolen cheque number and verify your account as you usually would. If it has been used, report fraud immediately.

If it hasn't been used, contact the bank with your account information and cheque number to request a stop payment to cancel a cheque. Usually, your bank will allow you to void a lost cheque through an online process or by calling a phone number. Once the bank authorizes the stop payment, you're safe, but you might have to pay a cancellation fee.

How to Print A Void Cheque

In many cases, printing void cheques is as easy as logging into your online banking account and finding the void cheque. You should be able to print a copy of it once it has been authorized. It is recommended that you do so to keep for your own records

Can You Print Out A Void Cheque Online?

If you are looking to print a blank cheque that is already void, it is possible to use a cheque printer to generate an image of a blank cheque with the word "void" on it for you to fill out and send in. This option is not always valid, however, so you'll need to check with the company to find out what they accept.

How to Void A Cheque and More

There aren't many times in your life that you'll need a cheque, but when you do, you can easily solve the problem online, in person, or over the phone.

If you're looking for more resources and tips on your finances, visit the Insurdinary blog or contact us!