Do you have a bad credit score or none at all? Have you struggled to get loans from banks? Consider getting a loan from LendingMate. They're a Canadian company that offers loans to borrowers with any credit score, as long the borrowers have someone to vouch for them.

Keep reading to learn about LendingMate and if it has the right loan rates for you.

Disclaimer:

All, or some of the products featured on this page are from our affiliated partners who may compensate us for actions and or sales completed as a result of the user navigating the links or images within the content. How we present the information may be influenced by that, but it in no way impacts the quality and accuracy of the research we have conducted at the time we published the article. Users may choose to visit the actual company website for more information.

What Is LendingMate?

LendingMate offers loans to borrowers who can't get loans from banks or other institutions. It's an excellent alternative to payday loans because it doesn't have fees and as high of an interest rate.

Residents of British Columbia, Ontario, and Quebec can use LendingMate. You don't need a credit score to apply, but you will need to have a guarantor, who will vouch for you and will pay back the loan amount if you cannot.

What Is a Guarantor?

A guarantor can help you get a loan by promising to pay if you don't pay. If something happens to you or you just don't have the money, it will be up to your guarantor to pay the balance. Loans with a guarantor rely on the guarantor's credit score. You can choose a friend or relative, but they will need a good credit history for you to get a loan.

How Does LendingMate Work?

Getting a loan from LendingMate can be a simple and fast process. Once you choose a guarantor, you can apply for a loan up to $10,000.

If you need more money, you may want to consider a different lender. Or you could elect another person as guarantor for a second loan. But you should always be prudent of your ability to pay back the amount you owe.

How to Get a LendingMate Loan

While the process is straightforward, you should follow each step attentively.

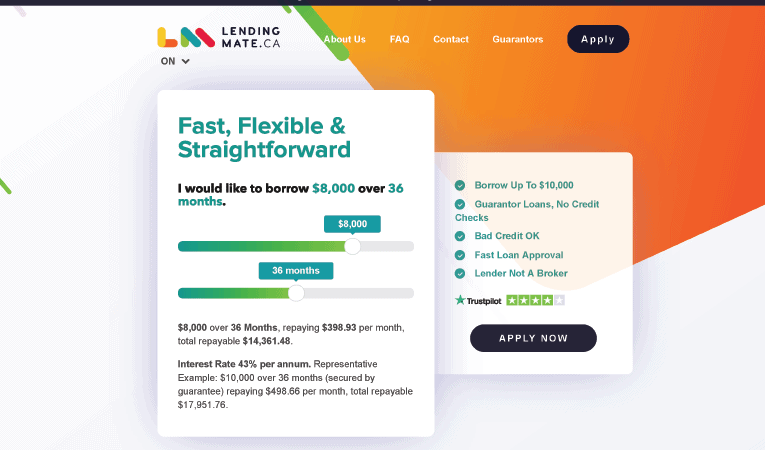

Calculate Your Loan Amount

LendingMate makes it easy to calculate how much money you can get, and to figure out your payment amounts. This is an excellent tool for borrowers because you can see if you need to lower your loan amount or extend the term.

You can plug in different loan amounts and term lengths to see your potential monthly payments and how much you will pay in interest.

LendingMate will increase the minimum term length for larger loans. For example, a $2,000 loan can have a term as short as 12 months. Loans over $3,000 will last at least 24 months, and a $5,000 loan will have a term of at least 36 months. You will always have the option of choosing the maximum term, which is 60 months. But you can also pay more than your monthly amount (without any fees attached) to pay off the loan faster.

Apply Online

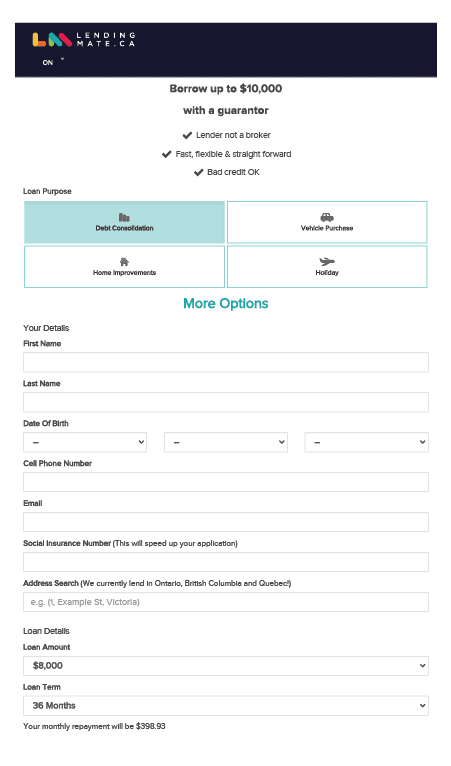

Once you're ready to apply for a loan from LendingMate, you go through their online application on their website. You will have a variety of options what your loan is for:

- Debt consolidation

- Home improvements

- Holiday

- Vehicle purchase

- Rent deposit

- Business

- Student loan

- Helping family

- Other

If you don't see something that represents your reason for a loan, you can also select the "Other" option.

Next, you will fill out your name, date of birth, and contact information. Unfortunately, you have to have an address in British Columbia, Ontario, or Quebec to apply since, as previously mentioned, LendingMate is only available in those provinces.

Adding your Social Insurance Number will help make your application process go faster and more smoothly. You will also select your loan amount and term, and you will be able to check what your monthly payments will be.

LendingMate

Fast, Flexible & Straightforward

Apply now Forward the Application to Your Guarantor

After you fill out all of your information, you will need to send the application to your guarantor. LendingMate will provide you with a link that you can include in an email or text message.

Your guarantor will need to provide their information so that LendingMate can review their credit history and other details.

If possible, it can help to fill out your portion and your guarantor's portion of the application back to back. But sending a link can be a good option if you don't live together or if you have different schedules.

Confirm the Details

After you and your guarantor fill out the loan application, LendingMate will call you to make sure you understand the loan amount and term. They will also verify some details to make sure you and your guarantor can get the loan.

Once they confirm that you understand the loan terms and that you are eligible, they can approve your guarantor. The approval may happen within a few minutes, or it may take a while.

LendingMate will need to review your guarantor's credit history and other details. You can speed up the process by choosing someone trustworthy and with a good credit history.

Get the Loan Money

To avoid instances of fraud, your guarantor will get the money from LendingMate if the company approves your loan. Once your guarantor gets the money, they can transfer it to you.

Paying the Loan Back

You'll need to make the monthly payments, which include your principal and interest. LendingMate will take a direct debit withdrawal from your account each month, and they may ask for a debit or credit card to use in case the direct debit method doesn't work.

If both methods don't work and LendingMate can't contact you, they will contact your guarantor for payment. Your guarantor will then have to pay the owed amount for you. But if your guarantor doesn't pay the loan, LendingMate will take legal action against both the borrower and the guarantor.

Is LendingMate Safe?

LendingMate is safe to use. The company has some good and bad reviews on Trustpilot, but the bad reviews tend to be about how strict the application process is. Bad reviews mention issues communicating with borrowers and guarantors, and that LendingMate may take a while to get back. Positive reviews praise LendingMate for quick and and efficient service. It appears that while they customer service can be timely and responsive, they're inconsistent.

LendingMate is still a much better alternative to payday loans, and a great option if your credit score is preventing you from accessing loans from banks or other moneylenders.

Pros of LendingMate

While no loan program is perfect, LendingMate offers some options and features that make it a worthwhile lender.

Credit History Requirements

If you have poor credit or no credit at all, you can get a loan through LendingMate. You can do so through a guarantor that does have good credit.

Unemployed People Can Apply

If you've had a hard time getting a loan because you don't have a job, that can be frustrating. Luckily, you don't need to have a job or show proof of income to get a loan through LendingMate. The loan can help you get through a period of unemployment while you look for a job.

Simple Process

Another positive of LendingMate is that their application process is simple and fast. You will know your monthly payments before you apply, so you can select the right loan amount and term for your situation.

The company also doesn't charge any extra or hidden fees, so you know what you can expect to pay once you get the loan.

Better Alternative to Payday Loans

If you need money in a pinch, it can be tempting to get a payday loan. But payday loan interest rates are much higher than for any other loan. While LendingMate interest rates aren't generous, they're better than what you can get from a payday lender and you can get your funds just as fast.

Cons of LendingMate

Higher Interest Rates

If you have decent credit, you may want to start your search with traditional moneylenders to save on interest. Even though LendingMate doesn't charge as much interest as payday lenders, they still charge a lot.

The interest rates range from 34.9% to 43% per annum depending on your province. And if you need a lot of money, that interest can add up quickly.

Low Maximum

Another downside of LendingMate is that you can't get more than $10,000 per loan. While it's possible to apply for multiple loans with different guarantors, you may not have enough money to balance multiple loan payments at a high interest rate.

If you need a loan to buy a new car, or do significant repairs on your current home, LendingMate loan may not be enough.

Geographic Restrictions

Not everyone in Canada can apply. You can only get a loan if you live in British Columbia, Ontario, or Quebec.

Minimum Loan Terms

While you can set up a $2,000 loan with a 12-month term, that's not the case with larger loans. If your loan is $3,000 or more, you will need to select a term of at least 24 months. And the minimum term only goes up from there.

While you can pay more than your monthly payment to pay off the loan in less time, you should still consider how long you want to make payments for and if you can get a shorter term elsewhere at a lower rate.

Is LendingMate for You?

LendingMate is an excellent Canadian lender for borrowers with poor or no credit. You can get a decent amount of money, but you will need someone to act as your guarantor.

Once you find a guarantor, you can apply for a loan of up to $10,000. You can apply online, and you can get your money within 24 hours after approval. LendingMate is trustworthy, although some user reviews mention that they tend to take their time when communicating with customers. If you need a loan but traditional lenders do not provide you with one, LendingMate is a great alternative.