In Canada, buyer behaviours are continually moving towards digitisation.

Online banks have become popular for their favourable rates when it comes to investing and saving. Today, your best choice isn’t necessarily the big banks that have traditionally held a market stronghold.

Accordingly, more consumers are choosing online banking. Banks such as Motive Financial have emerged to meet this demand.

Are you curious to discover how Motive Financial can help you to manage your finances better? Do you want to know if this bank is the right choice for your needs? Let's find out.

What Is an Online-Only Bank?

Online-only banks are digital banking services that function through a mobile app or website. They aren’t much different from traditional banks. However, they don’t have physical branches.

Digital banking is blossoming both in Canada and beyond, enjoying significant growth since 2015. By 2022, the financial technology (fintech) industry is expected to grow to $130 billion.

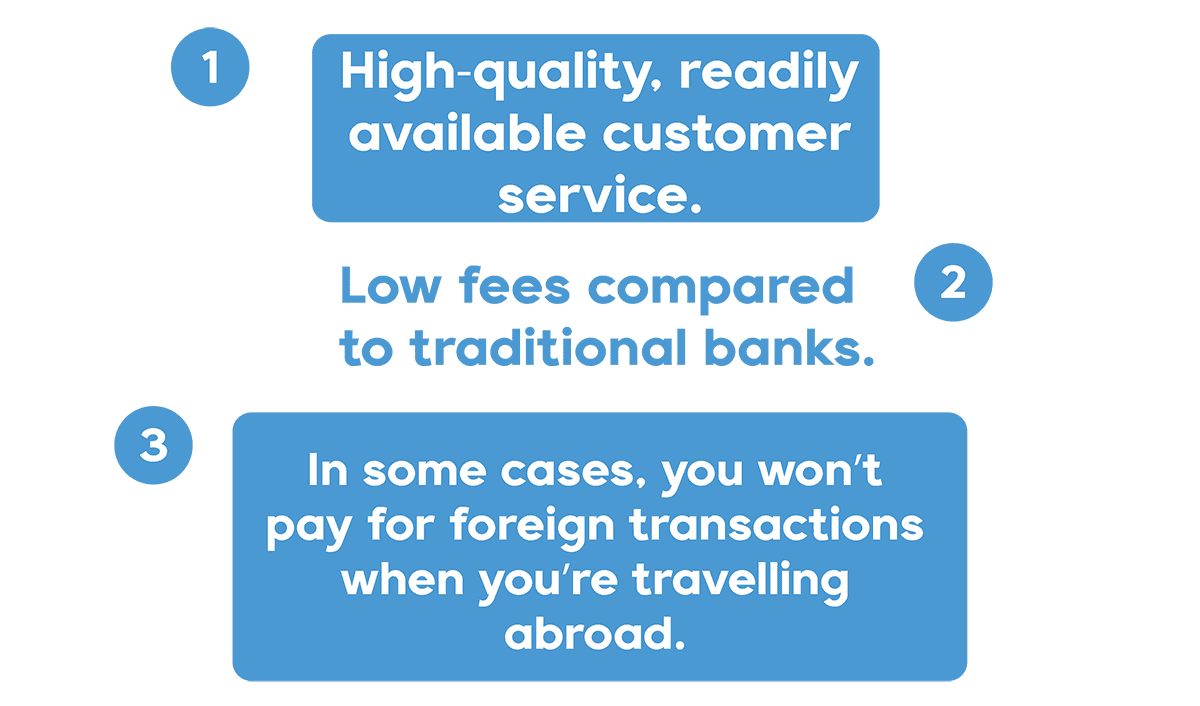

Online banks provide debit and credit cards to their customers. You can use them to pay for items in land-based stores and withdraw from ATMs when desired. The main benefits of using online-only banks include:

What Is Motive Financial, and Is It Safe?

Motive Financial is one of the institutions leading Canada’s online-only banking revolution.

Though based in Edmonton, Alberta, the company serves users throughout the country. Whether you live in Vancouver or St. Johns, you can use their service.

Motive Financial customers can access their accounts either via their laptop or smartphone. Although the company has no physical branches, customer service is provided online, over the phone, and through social media.

Motive Bank is very safe to use and well-trusted by its customers. Motive Financial is part of the Canadian Western Bank, also based in Edmonton. The banking service is also a Canadian Deposit Insurance Corporation (CIDC) member. All CDIC member banks must guarantee deposits up to $100,000.

Available Account Types

Motive Financial offers two basic account types — checking and savings.

Checking Accounts

There are two standard Motive account types, the Motive Checking Account and the Motive Cha-Ching Checking Account. A Cha-Ching Checking account has a slightly higher interest rate than the standard checking account.

Both accounts are available to all qualifying members in Canada. Customers can use the service each day for free and earn interest on the money in their account.

Motive’s Checking account users can also withdraw their money at ATMs if desired. The bank has the second-largest network of cash points in the country, meaning withdrawal options are almost always available.

The Motive Checking account also offers access to 50 personalised check styles. Furthermore, you can schedule payments, pay your bills, and make transfers via INTERAC. Joint accounts are also available.

Savings Account

While you can earn interest on your money in a standard checking account, you might want to look at the Motive Savings account to maximize your earning potential.

Like their checking account, Motive’s Savings account is available throughout Canada. You’ll earn interest on all of your savings, no matter how much or little you have. There are two separate brackets for earnings—more on interest rates in a moment.

Also, if you want to withdraw some of your savings, you can take advantage of two free monthly withdrawals. Whether you have $10 or $1 million, you can use your Motive Savings account for free. Like the standard Checking account, you can also open a joint Savings account.

Investing with Motive Financial

Motive offers day-to-day banking. However, the firm also makes it easy for you to invest. With Motive’s TFSA, RRSP and non-registered account offerings, you can grow income for the future.

In most instances, you’d use an RRSP account to save for retirement. However, you might use a TFSA for any reason.

The TFSA contribution limit is $6,000 or 18% of your income, whichever is lower. If you don’t contribute the maximum amount, your contribution will carry forward to the next year.

RRSP contributions are tax-deductible. Yet, TFSA contributions are not.

However, RRSP withdrawals are subject to taxes. However, you can withdraw TFSA funds at any time without incurring taxes.

The Motive TFSA Savings Account

Motive’s TFSA savings account allows you to save faster with a tax-free interest rate of 1.550%. There’s no minimum balance for the account.

Also, there’s no monthly fee for the Motive TFSA savings account. However, you’ll need to make sure that you don’t exceed the $6,000 monthly limit. You’ll also need to ensure that you don’t surpass the lifetime contribution limit.

Motive RRSP Account

A Motive RRSP account is more suited for long-term investments. Again, it’s a great way to save for retirement.

The account features a guaranteed interest rate. Also, your earnings are tax-free until you withdraw them. For this reason, the Motive RRSP Account is best suited for short-term savings.

Non-Registered GIC

There are a few differences between the RRSP and GIC accounts for non-registered users. For the most part, though, they’re pretty similar.

With the standard Motive GIC account, you’ll earn guaranteed interest on your earnings. Furthermore, you can deposit as little or as much as you like

Like an RRSP account, you’ll also earn increasing interest on your deposits for ten years after the first deposit. Motive’s non-registered RRSP account also includes interest rates that are competitive with other online-only banks in Canada.

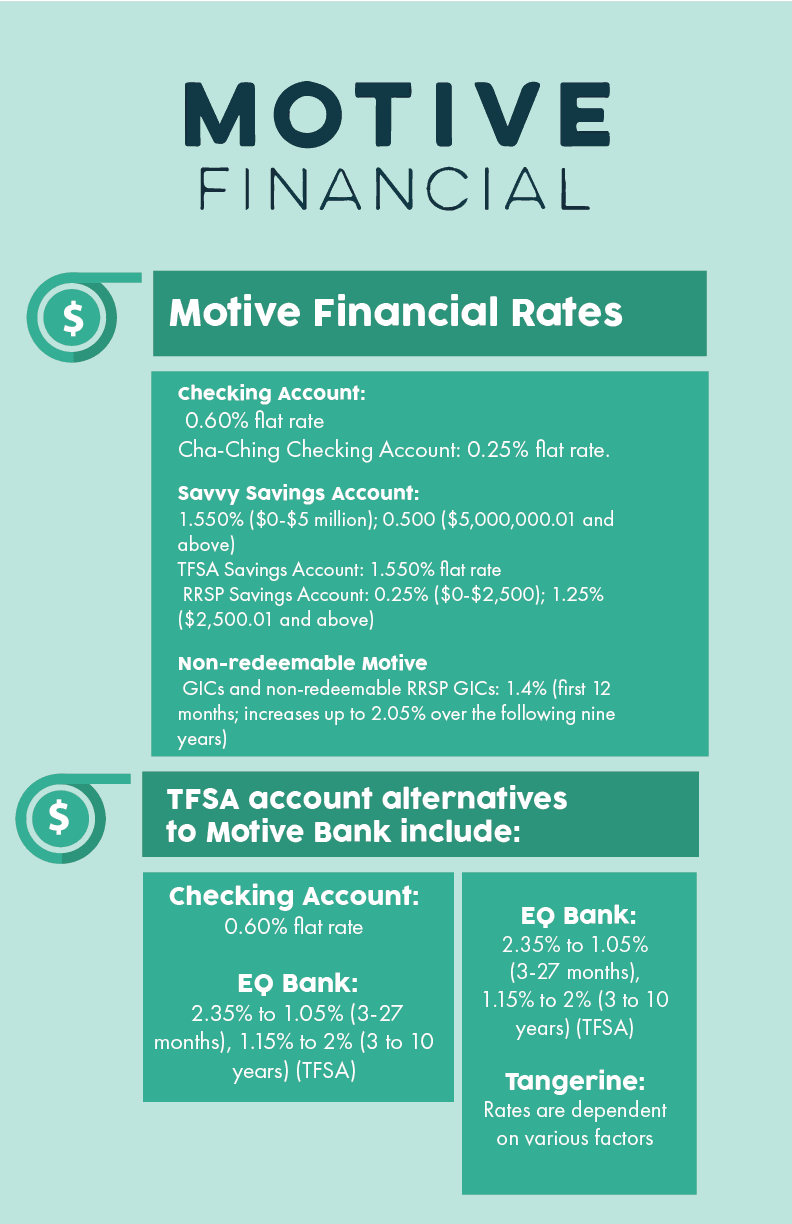

Motive Financial Rates

Motive has very competitive rates for online banking, saving, and investing in Canada. The most important starting interest rates are as follows:

What Fees Are Associated with Motive Financial?

You won’t pay a monthly fee to use Motive Bank. However, you’ll need to pay fees for certain transactions. These transactions include:

• Checking Account: $1.50 (non-EXCHANGE ATM withdrawals); $1 (INTERAC e-transfer)

• Savings Account: $5 (withdrawals after the two free transaction limit); $1.50 (non-exchange ATM withdrawals); $1 (INTERAC e-transfer)

• Unauthorised overdrafts: $5 minimum per item

• US item deposited as Canadian: $15

• Account closure within 90 days of opening: $15

Pros and Cons of Motive Financial

In short, the pros of using Motive Bank are:

• Favourable and competitive interest rates for savings and investment accounts

• High withdrawal limits per transaction (you can withdraw up to $150,000 in a single transaction)

• A wide range of banking, saving, and investment account options

The cons of using Motive Bank are:

• No land-based branches

• You can only make two free withdrawals each month when using investment accounts

• If your account is inactive for two years, you must pay a $20 maintenance fee

In the end, however, Motive Financial has impressive product offerings. For your day-to-day banking needs, you may want to give Motive Financial a try.

Our Complete Motive Financial Review for 2021

Having gone through this Motive Financial review, you’ll now have a good idea about whether this online bank is the right fit. The interest rates alone make Motive financial well worth your consideration. What’s more, loyalty to Motive Bank can pay off nicely.

Motive users enjoy increasing annual interest rates, plus more freedom to withdraw their money when they want it. Motive is also free to use monthly, though some consumers may not like the lack of physical branches.

Overall, Motive is a well-rounded and safe option if you’re looking for daily banking or to save your money and invest further.

When picking the right bank, you need to assess all your options. Same goes for insurance, and a leading Canadian financial comparison platform we can help you get the best rates and coverage for your insurance needs.