Did you know that, according to the Canadian Bankers Association, there are 96.8 million MasterCard and Visa cards circulating in Canada? Additionally, for 82% of Canadians, rewards are a priority when they’re selecting a credit card.

If you’re a Canadian looking for a new card, then you might be considering getting the TD Aeroplan Business Visa.

However, with so many cards to choose from, you might not be sure if it’s the right card for you. You might be asking yourself questions such as:

“What are the pros and cons of the TD Aeroplan Business Visa?”

“What are its features and benefits?”

“What are the travel perks?”

If you don’t have the answers to these questions, then you might not be sure about whether the TD Aeroplan Business Visa is right for you. That’s why we’ve put together this TD Aeroplan Business Visa Review. Once you know all about this card’s features, benefits, points system, and more, you can decide if you want this card.

Disclaimer:

The content in this article or page is for informational purposes only. While we only conduct the most thorough research and evaluations, and update our content continuously, we cannot guarantee 100% accuracy of the details shown. Users may choose to visit the actual company website for more information.

TD Aeroplan Visa Business Overview

The TD Aeroplan Business Visa, which was overhauled in 2020, is a great credit card for anyone who loves to travel. It comes with many features such as travel perks, a travel insurance package, and competitive earn rates.

Whether you want to take advantage of the points you can easily earn, collect Aeroplan points, or take advantage of additional travel benefits like TD Aeroplan Business Visa car rental insurance, you should consider the TD Aeroplan Business Visa.

What Is a Business Credit Card?

In order to apply for a business credit card, you need to be an owner or signing officer of the business using the card. When applying for a business card, you apply for it not for you but for your business. But it doesn't mean that your credit score doesn't matter.

A card issuer is likely to check both your credit history and your business' creditworthiness. Additionally, issuers often require you to sign a personal guarantee that you will be responsible to repaying your business credit card debt if your business defaults.

This means that your personal credit may either improve or suffer based on your usage of the business card. So remember to always pay your balance in full and on time!

The Pros and Cons of This Card

Pros

When it comes to Aeroplan Points, the TD Aeroplan Business Visa has a high earn rate. Whenever you spend $1 on eligible purchases, you generate 1.5 points. Also the insurance you get through this card is the type of insurance that travelers actually want to get, more on that later. Additionally, there’s a welcome bonus you get if you apply by 30 May 2021.

Here’s how the welcome bonus with the TD Aeroplan Business Visa works:

You and any additional cardholders will get an Annual Fee Rebate for the whole first year you have the card. Additionally, when you make your first purchase, you’ll automatically earn 10,000 Aeroplan points. Then, you’ll earn 15,000 more Aeroplan points when you’ve spent $5,000 within the first 90 days of having opened your account.

You'll also get BuddyPass as part of the introductory offer. Whenever you buy a flight through AirCanada that’s economy and flies to anywhere in Canada, you can get a free flight for an additional passenger to go with you. They’ll only have to pay for fees and taxes, but not for the flight itself. You'll have a whole year to use it.

Cons

One of these is that you don’t have true lounge access. Even though you used to get lounge access with Aeroplan cards, you don’t anymore.

Another con is that you can only use the travel points you earn for flights with Air Canada. This limits your choices when it comes to travel.

Features and Benefits

This card is part of Visa SasingsEdge Program, it offers discounts up to 25% for eligible business purchases. Let's explore other perks in greater detail:

Travel Insurance Coverage

Wherever you’re going, you’ll have the insurance you need. Your coverage includes $2,000,000 for medical (for the first 15 days for anyone 65 and under, and for 4 days for anyone over 65; you can get additional top-up coverage).

Additionally, the travel insurance covers travel accidents (for up to $500,000), trip cancellation (for up to $1,500 for each person with a maximum of $5,000), and trip interruption (for up to $5,000 for each person with a maximum of $25,000).

Travel insurance with the TD Business Visa also includes coverage for a flight or trip delay ($500 if trip is delayed for over 4 hours), delayed or lost baggage (up to $1,000 after 6 hours of delay), TD Aeroplan Visa Car Rental Insurance for up to 48 days, and stolen items (from motels or hotels, up to $2,500).

Free First Checked Bag

Not only is your first checked bag free, but up to 8 people traveling with you will also have their first checked bag flown at no cost. This only applies if you’re traveling on an Air Canada flight.

Considering that checked bag fees can be $30 or more, you could save up to $270 by taking advantage of this perk.

Emergency Travel Assistance Program

If you’re a regular traveler, then you know how important it is to have someone to contact if you suddenly run into an emergency while traveling. There’s a toll-free number available to you as a cardholder anytime you have a travel emergency.

No Expiration of Points

If you’ve had travel cards in the past, you know how annoying it can be to rack up a large number of travel points only to find that you can’t use them before they expire. With this card, you won’t have that problem. As long as you’re in good standing when it comes to your credit card, your points will never expire.

NEXUS Membership

You can also get rebates of $100 through this card that you can put toward your NEXUS membership. If you plan on traveling often to and from the US, this will make the process of crossing the border much easier. Keep in mind that this would apply one time every 48 months.

Earning and Redeeming Points

One of the best features is that you get points not only when you travel, but anytime you spend. It works like this. For every $1 you spend on eligible grocery, gas, and aircanada.com purchases, you’ll earn 1.5 Aeroplan points.

For every $1 you spend on other purchases, you’ll earn 1 Aeroplan point.

Note this: if you make a purchase at the Aeroplan Store or at a participating retailer, you’ll earn twice the amount of points. So, for every $1 you spend, you’ll earn 2 Aeroplan points. Additionally, until 7 November 2021, you’ll earn 1.5 for every $1 you spend at Starbucks.

Whether you're traveling to another country or to the office, you can earn points when you're drinking your morning coffee.

The Aeroplan store isn’t just a place where you buy travel-related items or services. In this store there are 170 retailers. These retailers include Hudson’s Bay and the Gap, and over 150 others.

All you have to do is present your membership card and you’ll be earning points.

Redeeming Your Points

To redeem your points, you follow a simple process. All you have to do is use the AirCanada app or go to the AirCanada website. Then, all you have to do is log in, where you can easily use your points to book travel.

Fees and Rates

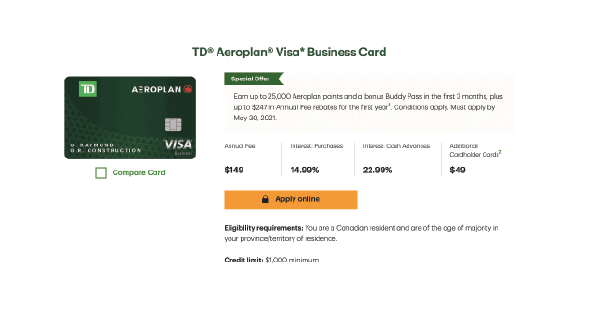

The first fee you should be aware of is the $149 annual fee. However, note that, if you get approved by 30 May 2021, you can get the Annual Fee Rebate. You, the primary cardholder, will get this rebate, as well as any additional cardholders. This is only for the first year of use.

The Additional cardholder fee is $49. The foreign transaction fee, which is important to be aware of for anyone who travels often, is the standard 2.5%

Rates

For purchases, you’ll pay 14.99%; as for cash advances, you’ll pay a standard 22.99%. That is, of course, if you don't pay off your balance in full.

Applying for This Card

To apply for this credit card is a simple process. Once you’ve ensured that you meet the eligibility requirements, you can go to TD's website to apply online. You will need to provide personal information and your company's information, but it should be a fast process.

The Verdict in this TD Aeroplan Business Visa Review

The TD Aeroplan Business Visa is one of the best cards out there for Canadian business owners who love to travel and earn points whenever they spend. Even though you’ll be limited to AirCanada flights, you can still gather considerable travel rewards.