Did you know that pet insurance is a thing? However, while Canadians spend a good deal of their money on their furry kids, less than three percent have pet insurance.

Having insurance in any situation is imperative, and companies like Allstate provide types of insurance such as pet, car, commercial, home, condo, and rental. While you never want to have to use your insurance, it's vital that if the time comes that you need to file a claim, you know how to.

Keep reading to learn how to file Allstate Insurance claims, so the process is seamless.

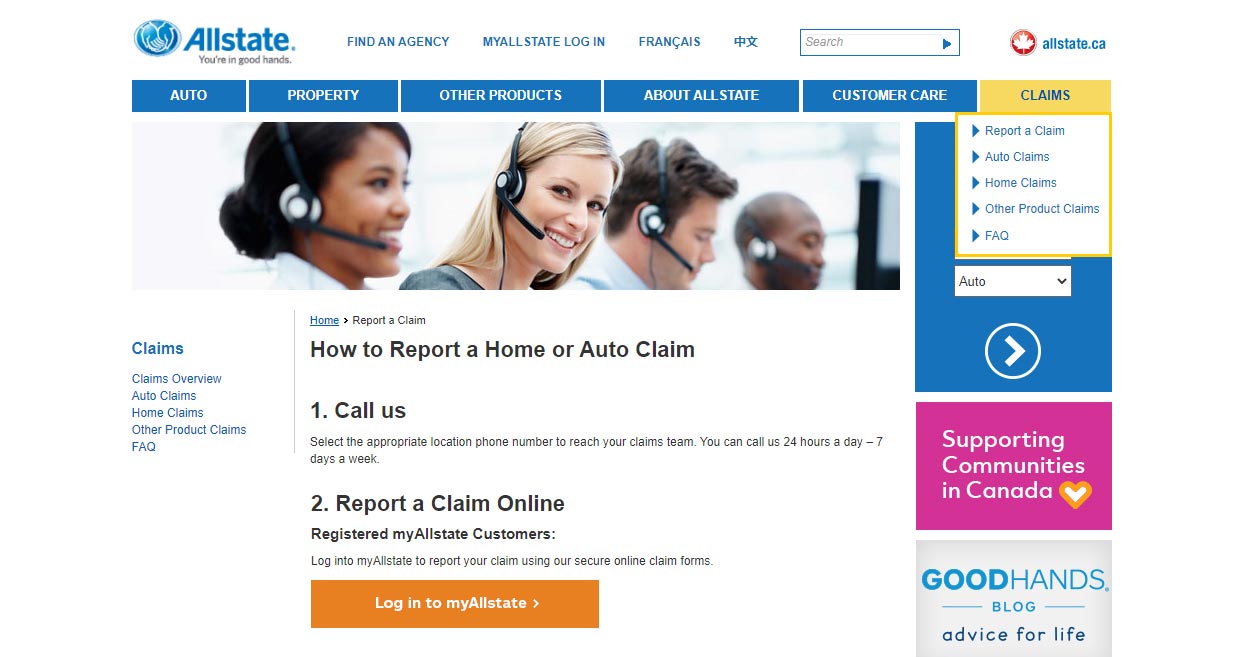

Submitting Allstate Insurance Claims Online

You can report a home or auto claim online. To submit online, you first need to log into your Allstate account. You can do so here.

If you don't have an online account set up, you will need to set it up. Signing up has other benefits beyond being able to report a claim.

You can also:

- Pay bills

- View policy details

- Make changes to your coverage

- File a claim

- Access the Allstate app

If you haven't signed up for online access, you can do that here. You will need your policy number and web ID number.

Both of these numbers can be found on your policy documents.

Once you have logged into your account, you can file a claim there.

Through Your Medical Provider

Do you need to submit a claim through your medical provider? Your physician will require you or your representative to sign a release of information.

This will allow them to communicate with your insurance provider. Your medical provider is likely familiar with working with insurance companies; call Allstate for the paperwork needed and work with your provider to get it filled out.

Submitting Allstate Insurance Claims Via Mail

If technology really isn't your thing, you can mail your claim forms in. Fill out the forms needed and give Allstate Insurance a call. They can help walk you through the whole process.

They are open 24 hours a day and seven days a week.

- Alberta, British Columbia, Manitoba, Saskatchewan

- Toll-Free: 1-800-661-1577

- Local: 403-974-8700

- Ontario

- Toll-Free: 1-800-387-0462

- Local: 905-477-5550

- Quebec

- Toll-Free: 1-800-463-2813

- Local: 514-351-5335

- Nova Scotia, Newfoundland, Prince Edward Island, New Brunswick

- Toll-Free: 1-800-561-7222

- Local: 506-859-7820

- USA

Via Mobile App

Are you ready to submit your insurance claims from your phone? The Allstate insurance app allows you to do just that.

If you're more comfortable with the technology in your hand, all you need to do is download the app.

Are you an Android user? You can download the app through Google Play here.

Do you prefer an iPhone? We have the link for you too. You can download it from the app store here.

Submitting a Claim When I Have Another Plan

Do you need to file a third-party claim? It is when you file a claim with the at-fault driver's insurance company.

This probably sounds complicated; however, it's not. Your insurance provider can take the reins and communicate with Allstate on your behalf.

This simplifies the process. You will likely work with an insurance adjuster or claims representative through this process. However, contacting your own insurance is the first step to this process.

Other Claims

Do you need to report a claim for something other than auto or home insurance? You can find the information you need to contact Allstate's marketing partners here.

What to Do for Auto or Home Insurance Claims

If you need to file an auto or home insurance claim, there are some steps you should take. These steps will help to guarantee your safety as you get the process started with Allstate Insurance.

Auto Insurance

For auto insurance, there are a few steps to take depending on the situation. However, no matter what the situation is, never admit fault.

This means that you should not sign anything that assigns fault to you or make any promises to pay for damages.

Collision

After a car accident, there are some safety measures you can take to ensure the situation does not become worse.

Move your vehicles off the road if you're able to do so. Make sure you turn on your hazard lights, and if you have flares or emergency cones, utilize them appropriately to warn oncoming traffic.

If any of the following situations apply, call the police:

- Someone is hurt

- Vehicles are not moveable due to condition

- The driver is under the influence

- You think you're the victim of a staged or caused collision

Keep Track of Information

When you're in a car accident, it can be very nerve-wracking. Keeping track of the information needed can often feel overwhelming when you're feeling shaken.

Some of the information you will need to keep track of includes:

- Police details

- Names of other people involved

- Names of witnesses

- Repair shop numbers

- Insurance information

- Vehicle information

- Passengers

- Many other details

However, when you're in the moment, you may forget this. We recommend printing this form provided by Allstate Insurance.

You can keep this form in your glove compartment, so it is easy to access should you ever need it. It will help you organize your information and remember what information to collect.

Take Pictures

Take pictures to document the accident. However, don't just take pictures of the vehicles. Make sure you take pictures of any injuries you sustain as well.

When Someone Is Injured

Was someone injured in the accident? Call for help and follow instructions given by emergency personnel.

If someone is injured, then you will work with a claims advisor through Allstate who specializes in handling claims like that.

Was Your Vehicle Stolen?

Going to where you parked and finding that your vehicle is gone is sure to bring about panic. The first thing you need to do is call the police.

In some situations, it's possible that the police will have the ability to recover your vehicle. However, don't worry.

Whatever happens, Allstate Insurance can help to guide you through the process if your car does get stolen.

What If Your Vehicle Is Totaled?

Your insurance adjuster will make the decision on whether your car is a total loss or can get repaired. There are various factors that go into this decision.

Some of these include:

- Extent of damage

- Type of damage

- Age of your car

If the cost of repairing your vehicle is more than the vehicle's value, it will get considered a total loss. Your insurance, in this circumstance, pays the cash value of your vehicle unless it exceeds the limits of your policy.

For example, if your insurance covers up to $10,000, but the car is worth $12,000, they will only pay $10,000. If you have a deductible, the deductible will get subtracted from the payment.

If your payment is $10,000, but you have a $500 deductible, you will receive $9,500.

If Your Repairs Exceed the Estimate

When it comes to repairs, the simplest option is to work with a Priority Repair Option repair shop that is recommended by Allstate.

When you do this, the shop will work directly with Allstate to discuss the increase in the cost. However, if you decide on a different shop, then the shop needs to contact Allstate to talk about additional costs that are related to the damage.

Home Insurance

If your claim is for home insurance, it will look slightly different. There are many questions that can't get answered until you have spoken with an insurance agent.

You will want to contact Allstate as soon as you can, and they will help to guide you through the process.

What Gets Covered?

What gets covered depends on your policy what happened. Your Allstate Insurance agent will review your policy and your coverage with you during the process.

What Information?

Your Allstate agent will work with you to gather the details needed to make a decision on your claim. This is why you want to call as soon as possible to get the ball rolling.

Even if you don't have all the information, getting the claim started will help with timing. If your belongings have been stolen, you will need to provide proof of ownership.

Proof of ownership can include:

- Receipts

- Owner's manuals

- Warranty cards

- Appraisals

- Photographs

- Original manufacturer's boxes

If you're able to provide this proof, it helps to support your claim and expedite the process.

File Allstate Insurance Claims With Ease

Filing Allstate Insurance claims shouldn't add stress to your life. Use our guide to help you through the process and get on with your life.

Do you need life, health, travel, pet, or any other type of insurance? Insurdinary is here to help you find the lowest rates.

Request a quote through us today and get covered.